Eurostat has issued a publication to inform regarding the unemployment rate in Euro area for July.The euro area (EA19) seasonally-adjusted unemployment rate was 10.1% in July 2016, stable compared to June 2016 and down from 10.8% in July 2015. This remains the lowest rate recorded in the euro area since July 2011. The EU28 unemployment rate was 8.6% in July 2016, stable compared to June 2016 and down from 9.4% in July 2015. This remains the lowest rate recorded in the EU28 since March 2009. These figures are published by Eurostat, the statistical office of the European Union. Eurostat estimates that 21.063 million men and women in the EU28, of whom 16.307 million were in the euro area, were unemployed in July 2016. Compared with June 2016, the number of persons unemployed decreased by 29 000 in the EU28 and by 43 000 in the euro area. Compared with July 2015, unemployment fell by 1.688 million in the EU28 and by 1.034 million in the euro area.

Eurostat has issued a publication to inform regarding the unemployment rate in Euro area for July.The euro area (EA19) seasonally-adjusted unemployment rate was 10.1% in July 2016, stable compared to June 2016 and down from 10.8% in July 2015. This remains the lowest rate recorded in the euro area since July 2011. The EU28 unemployment rate was 8.6% in July 2016, stable compared to June 2016 and down from 9.4% in July 2015. This remains the lowest rate recorded in the EU28 since March 2009. These figures are published by Eurostat, the statistical office of the European Union. Eurostat estimates that 21.063 million men and women in the EU28, of whom 16.307 million were in the euro area, were unemployed in July 2016. Compared with June 2016, the number of persons unemployed decreased by 29 000 in the EU28 and by 43 000 in the euro area. Compared with July 2015, unemployment fell by 1.688 million in the EU28 and by 1.034 million in the euro area.

Member States

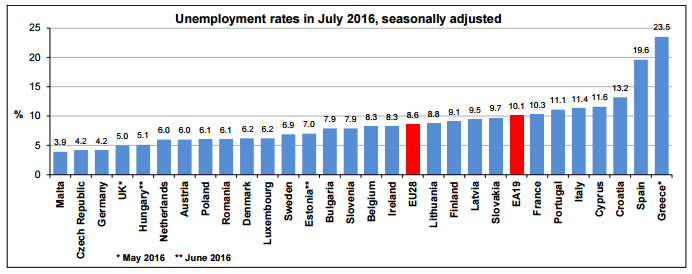

Among the Member States, the lowest unemployment rates in July 2016 were recorded in Malta (3.9%) as well as in the Czech Republic and Germany (both 4.2%). The highest unemployment rates were observed in Greece (23.5% in May 2016) and Spain (19.6%). Compared with a year ago, the unemployment rate in July 2016 fell in twenty-four Member States, remained stable in Denmark, while it increased in Estonia (from 6.1% to 7.0% between June 2015 and June 2016), Austria (from 5.7% to 6.0%) and Belgium (from 8.1% to 8.3%). The largest decreases were registered in Cyprus (from 15.0% to 11.6%), Croatia (from 16.5% to 13.2%) and Spain (from 21.9% to 19.6%). In July 2016, the unemployment rate in the United States was 4.9%, stable compared to June 2016 and down from 5.3% in July 2015.

Youth unemployment

In July 2016, 4.276 million young persons (under 25) were unemployed in the EU28, of whom 2.969 million were in the euro area. Compared with July 2015, youth unemployment decreased by 310 000 in the EU28 and by 136 000 in the euro area. In July 2016, the youth unemployment rate was 18.8% in the EU28 and 21.1% in the euro area, compared with 20.2% and 22.1% respectively in July 2015. In July 2016, the lowest rates were observed in Malta (7.1%) and Germany (7.2%), and the highest in Greece (50.3% in May 2016), Spain (43.9%) and Italy (39.2%).

Geographical information

The euro area (EA19) includes Belgium, Germany, Estonia, Ireland, Greece, Spain, France, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Austria, Portugal, Slovenia, Slovakia and Finland. The European Union (EU28) includes Belgium, Bulgaria, the Czech Republic, Denmark, Germany, Estonia, Ireland, Greece, Spain, France, Croatia, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Hungary, Malta, the Netherlands, Austria, Poland, Portugal, Romania, Slovenia, Slovakia, Finland, Sweden and the United Kingdom.

Methods and definition

Eurostat produces harmonised unemployment rates for individual EU Member States, the euro area and the EU. These unemployment rates are based on the definition recommended by the International Labour Organisation (ILO). The measurement is based on a harmonised source, the European Union Labour Force Survey (LFS).

Based on the ILO definition, Eurostat defines unemployed persons as persons aged 15 to 74 who:

- are without work;

- are available to start work within the next two weeks;

- and have actively sought employment at some time during the previous four weeks.

- are without work;

- are available to start work within the next two weeks;

- and have actively sought employment at some time during the previous four weeks.

The unemployment rate is the number of people unemployed as a percentage of the labour force. The labour force is the total number of people employed plus unemployed. In this news release unemployment rates are based on employment and unemployment data covering persons aged 15 to 74. The youth unemployment rate is the number of people aged 15 to 24 unemployed as a percentage of the labour force of the same age. Therefore, the youth unemployment rate should not be interpreted as the share of jobless people in the overall youth population.

Country notes

Germany, the Netherlands, Austria, Finland, Sweden and Iceland: the trend component is used instead of the more volatile seasonally adjusted data. Denmark, Estonia, Hungary, Portugal, the United Kingdom and Norway: 3-month moving averages of LFS data are used instead of pure monthly indicators.