Banca italiană "Monte dei Paschi di Siena" va scoate la vânzare noi acţiuni în perioada 19-22 decembrie, într-o ultimă încercare de a-şi majora capitalul în acest an cu 5 miliarde de euro şi a evita în acest fel solicitarea unui ajutor din partea statului, transmite Reuters. "Monte dei Paschi" a anunţat că oferta adresată investitorilor instituţionali, care reprezintă 65% din total, se va încheia joi. Oferta rezervată acţionarilor actuali şi persoanelor fizice va avea loc până miercuri. În încercarea de a atrage fonduri, "Monte dei Paschi" a prelungit o ofertă de schimb voluntar de obligaţiuni cu acţiuni, adresată investitorilor care deţin obligaţiuni junior ale băncii în valoare de 2,1 miliarde de euro. Oferta are loc în intervalul 16-21 decembrie. Guvernul italian este pregătit să susţină a treia mare bancă din ţară, dacă planul de atragere de fonduri nu va funcţiona. Potrivit noilor reglementări adoptate de Uniunea Europeană după criza financiară, investitorii într-o bancă cu probleme trebuie să suporte primii pierderile, înainte ca guvernul să intervină cu fonduri publice. O sursă apropiată situaţiei a declarat vineri că salvarea de către stat a "Monte dei Paschi" implică mai întâi conversia obligatorie în acţiuni a unor obligaţiuni subordonate în valoare de 4,1 miliarde de euro.

Showing posts with label agenda de business. Show all posts

Showing posts with label agenda de business. Show all posts

Monday, December 19, 2016

Saturday, December 17, 2016

In the future, Romania may not receive funding from international organizations such as the IMF or the EU. "There are no guarantees that the IMF, EU or other supra-national or international organizations will make available to Romania similar financing programs in the future. Both the current account and the budget deficit are rising. If these deficits are going to require the availability of future financing, Romania may pass additional measures that could hinder economic growth". NBR officials declined to comment on the statements included in the MedLife IPO prospectus. Last month, Lucian Croitoru, advisor to NBR governor Mugur Isărescu, warned that Romania was closer than one may think "either to an adjustment towards its potential, or towards recession", if the adjustments aren't made on time. He wrote, on the NBR blog, that the monetary policy is more relaxes than intended, and the "relaxed fiscal policy has generated a fiscal impulse which stimulated the economy more than would have been implied by the negative amount of the GDP gap". This process whereby the VAT cuts and salary increases stimulate other countries' economies cannot last, and the inflation driven exclusively by demand will increase, Mr. Croitoru said. He added: "In that context, the measures from 2016, to cut VAT by 4 percentage points together with the significant increase of wage expenditures, are not sustainable. They are putting pressures on the current account deficit and on inflation". This year, NBR governor Mugur Isărescu has warned on several occasions against the fiscal relaxation measures passed together with salary increases in an electoral year.

In the future, Romania may not receive funding from international organizations such as the IMF or the EU. "There are no guarantees that the IMF, EU or other supra-national or international organizations will make available to Romania similar financing programs in the future. Both the current account and the budget deficit are rising. If these deficits are going to require the availability of future financing, Romania may pass additional measures that could hinder economic growth". NBR officials declined to comment on the statements included in the MedLife IPO prospectus. Last month, Lucian Croitoru, advisor to NBR governor Mugur Isărescu, warned that Romania was closer than one may think "either to an adjustment towards its potential, or towards recession", if the adjustments aren't made on time. He wrote, on the NBR blog, that the monetary policy is more relaxes than intended, and the "relaxed fiscal policy has generated a fiscal impulse which stimulated the economy more than would have been implied by the negative amount of the GDP gap". This process whereby the VAT cuts and salary increases stimulate other countries' economies cannot last, and the inflation driven exclusively by demand will increase, Mr. Croitoru said. He added: "In that context, the measures from 2016, to cut VAT by 4 percentage points together with the significant increase of wage expenditures, are not sustainable. They are putting pressures on the current account deficit and on inflation". This year, NBR governor Mugur Isărescu has warned on several occasions against the fiscal relaxation measures passed together with salary increases in an electoral year. Wednesday, December 14, 2016

Reuters writes that the 2 billion Euros "investment" needs to be approved by the European Commission, which needs to check whether the transaction occurs at the market price or if it represents a state aid. Shortly after, a report appeared in Italian daily La Stampa, where it is state that the authorities in Rome have asked for a 15 billion Euros financial aid from the European Stability Mechanism (ESM) to prop up Italy's banking system. Shares of Italian banks rose significantly following the news, with Monte dei Paschi, being the best "performer", with a rise of about 10%. "No request for the ESM is being prepared", a spokesperson of the Italian treasury said, according to Financial Times. With the resignation of the government led by Matteo Renzi, who has announced on his Twitter account that the budget law has been approved, Italy's "Aeneid" in the Eurozone enters a new stage and nobody knows when the country is going to turn that corner. As for Greece's "Odyssey", Bloomberg asks whether the plan to cut the debt burden isn't too small and applied too late, reminding that the IMF sees the fiscal targets as unrealistic and the debt as far too big. Right now all we have to do is wait, even though we probably won't have to wait as many years as have passed since the aggravated phase of the sovereign debt in Europe, to find out whether Greece and Italy will "kick the bucket" once they "turn that corner".

Reuters writes that the 2 billion Euros "investment" needs to be approved by the European Commission, which needs to check whether the transaction occurs at the market price or if it represents a state aid. Shortly after, a report appeared in Italian daily La Stampa, where it is state that the authorities in Rome have asked for a 15 billion Euros financial aid from the European Stability Mechanism (ESM) to prop up Italy's banking system. Shares of Italian banks rose significantly following the news, with Monte dei Paschi, being the best "performer", with a rise of about 10%. "No request for the ESM is being prepared", a spokesperson of the Italian treasury said, according to Financial Times. With the resignation of the government led by Matteo Renzi, who has announced on his Twitter account that the budget law has been approved, Italy's "Aeneid" in the Eurozone enters a new stage and nobody knows when the country is going to turn that corner. As for Greece's "Odyssey", Bloomberg asks whether the plan to cut the debt burden isn't too small and applied too late, reminding that the IMF sees the fiscal targets as unrealistic and the debt as far too big. Right now all we have to do is wait, even though we probably won't have to wait as many years as have passed since the aggravated phase of the sovereign debt in Europe, to find out whether Greece and Italy will "kick the bucket" once they "turn that corner". Tuesday, December 13, 2016

The International Monetary Fund, the third pillar of the creditors' Troika, has not yet accepted that and continues to ask for the application of a new debt reduction, so that it becomes bearable, as well as the continuation of the austerity programs. Even though the authorities in Athens have accepted the measures adopted in the Eurogroup meeting, once they got home they also "discovered" their true meaning. The measures for relieving the burden of the public debt will be applicable until 2060 and are subject to achieving the creation of a budget surplus of approximately 3.5% of the GDP over a ten year period, which will begin after the completion of the current bail-out program, in 2018. Apparently no one knows why the new proposals of the European creditors are realistic. What will be extremely realistic and painful will be the new taxes provided in the draft budget for 2017. According to an article from French newspaper Le Monde, new taxes will be introduced for personal vehicles, landline phones, TVs, fuel, tobacco, coffee and beer. Unfortunately, those taxes are missing one item, because there haven't been dance taxes introduced, as is happening in Brussels, where the local authorities have "rediscovered" a tax that was approved in the "50s and they send people undercover in bars and restaurants to make sure it is paid. Of course, the "optimism" displayed by the European and the Greek authorities is completely out of place. "The agreement of the Eurogroup represents a chance for Greece to turn a corner", said Euclid Tsakalotos, finance minister in the government led by Alexis Tsipras, except his statement was made in spring this year, according to daily Kathimerini. Nobody expected miracles right away back then, but there are no signals that Greece is ready to turn a corner, just like nobody expects the new tax hikes and the newly introduced taxes to generate a virtuous circle of growth. As strange as it may seem, the notion of "virtuous circle of economic growth" actually exists in the discourse of the authorities in Athens. As always their optimism runs smack dab into the attitude of German finance minister Wolfgang Schäuble. On the day of the referendum in Italy, Schäuble said, in an interview he gave Bild am Sonntag, that "Athens needs to finally apply the necessary reforms, or else it has no room in the Eurozone".

The International Monetary Fund, the third pillar of the creditors' Troika, has not yet accepted that and continues to ask for the application of a new debt reduction, so that it becomes bearable, as well as the continuation of the austerity programs. Even though the authorities in Athens have accepted the measures adopted in the Eurogroup meeting, once they got home they also "discovered" their true meaning. The measures for relieving the burden of the public debt will be applicable until 2060 and are subject to achieving the creation of a budget surplus of approximately 3.5% of the GDP over a ten year period, which will begin after the completion of the current bail-out program, in 2018. Apparently no one knows why the new proposals of the European creditors are realistic. What will be extremely realistic and painful will be the new taxes provided in the draft budget for 2017. According to an article from French newspaper Le Monde, new taxes will be introduced for personal vehicles, landline phones, TVs, fuel, tobacco, coffee and beer. Unfortunately, those taxes are missing one item, because there haven't been dance taxes introduced, as is happening in Brussels, where the local authorities have "rediscovered" a tax that was approved in the "50s and they send people undercover in bars and restaurants to make sure it is paid. Of course, the "optimism" displayed by the European and the Greek authorities is completely out of place. "The agreement of the Eurogroup represents a chance for Greece to turn a corner", said Euclid Tsakalotos, finance minister in the government led by Alexis Tsipras, except his statement was made in spring this year, according to daily Kathimerini. Nobody expected miracles right away back then, but there are no signals that Greece is ready to turn a corner, just like nobody expects the new tax hikes and the newly introduced taxes to generate a virtuous circle of growth. As strange as it may seem, the notion of "virtuous circle of economic growth" actually exists in the discourse of the authorities in Athens. As always their optimism runs smack dab into the attitude of German finance minister Wolfgang Schäuble. On the day of the referendum in Italy, Schäuble said, in an interview he gave Bild am Sonntag, that "Athens needs to finally apply the necessary reforms, or else it has no room in the Eurozone". Thursday, September 22, 2016

Russia’s Central Bank expects the crude glut on the global market to persist till 2017, according to the regulator’s report on monetary policy quoted by Tass. Oil price will decline to about $40 per barrel in 2016 and remain on this level in 2017-2019, the bank said. “The estimates of the supply and demand balance on the global crude market have not changed significantly, the surplus of oil supply is expected to persist till 2017. Taking this into account, the Bank of Russia has kept its base case forecast of Urals crude oil price by the end of 2016 at the level of $40 per barrel,” the report said.

A possible decision to freeze oil production by the exported countries will not have a significant effect on the demand/supply balance on the global oil market or oil price, the report said. “The negotiations on freezing oil production among OPEC countries and some large exporters outside the organization are unlikely to have a lasting effect on market conditions. This would be possible only if the parties have agreed on direct reduction of production in comparison with current levels, but such an outcome is very unlikely. A more likely solution – setting production and exports at the levels close to the current ones – will not significantly affect the demand/supply balance on the global oil market,” the report said. Earlier, Saudi Arabia and Russia’s energy ministers singed a joint statement aimed at stabilizing the crude market on the sidelines of the G20 Summit. The Ministers recognized the importance of maintaining the ongoing dialogue about current developments in oil and gas markets and indicated their mutual desire to further expand their bilateral relations in energy. Russian Energy Minister Alexander Novak told reporters that Russia and Saudi Arabia are going to discuss freezing oil production for 3 or 6 months, maybe more. The 15th International Energy Forum (IEF15) will be held in Algiers on September 26-28, 2016. According to the media, oil exporter countries might discuss freezing of oil production. Venezuela, Ecuador and Kuwait were the initiators of the discussion.

Wednesday, September 21, 2016

OMV Petrom proposes its shareholders a dividend worth a minimum 30% for this year, says a release sent to Bucharest Stock Exchange. “OMV Petrom currently targets, subject to adverse developments in the external market, a proposed dividend from the 2016 net earnings of a minimum of 30% in the case it is fully covered by the Company’s free cash flows before dividends,” reads the release. ”The above should not be considered an amendment of the Company’s existing Dividend Policy, which will remain unchanged, but only a further detailing of the general principles with respect to 2016 only.” Starting the 2017 financial year and beyond, unless otherwise approved, the general principles under the Company’s existing Dividend Policy will remain unchanged and applicable, as follows: “OMV Petrom S.A. (the Company) is committed to deliver a competitive shareholder return through the business cycle, including paying an attractive dividend, subject always to maintaining a strong balance sheet that will enable the Company to finance its investment needs and to the shareholders’ approval.” OMV Petrom recorded a consolidated net profit of EUR 26 million in the second quarter of this year, down by 83% compared to the same period of 2015. The group’s consolidated sales declined by 20% in the three months ended June 31, 2016, to EUR 807 million.

OMV Petrom proposes its shareholders a dividend worth a minimum 30% for this year, says a release sent to Bucharest Stock Exchange. “OMV Petrom currently targets, subject to adverse developments in the external market, a proposed dividend from the 2016 net earnings of a minimum of 30% in the case it is fully covered by the Company’s free cash flows before dividends,” reads the release. ”The above should not be considered an amendment of the Company’s existing Dividend Policy, which will remain unchanged, but only a further detailing of the general principles with respect to 2016 only.” Starting the 2017 financial year and beyond, unless otherwise approved, the general principles under the Company’s existing Dividend Policy will remain unchanged and applicable, as follows: “OMV Petrom S.A. (the Company) is committed to deliver a competitive shareholder return through the business cycle, including paying an attractive dividend, subject always to maintaining a strong balance sheet that will enable the Company to finance its investment needs and to the shareholders’ approval.” OMV Petrom recorded a consolidated net profit of EUR 26 million in the second quarter of this year, down by 83% compared to the same period of 2015. The group’s consolidated sales declined by 20% in the three months ended June 31, 2016, to EUR 807 million.Tuesday, September 20, 2016

Once upon a time, there were five international audit, tax and audit consulting firms. Arthur Andersen disappeared in 2002, after it was convicted for the involvement in the Enron fraud. Since then, there have been four giants on this market, PricewaterhouseCoopers (PwC), Deloitte Touche Tohmatsu, Ernst & Young and KPMG, and some of their biggest clients are financial institutions. Bloomberg and Financial Times recently wrote that PricewaterhouseCoopers has been sued for "not having detected a case of fraud that led to the collapse of a bank during the global financial crisis". According to FT, the lawsuit in the United States "could bring more audit firms in the line of fire". The biggest lawsuit against an audit firm, according to Financial Times, has been brought following the complaint filed by the company that is in charge of the liquidation of Taylor, Bean & Whitaker (TBW), a mortgage originator in the US, which has been in a long-lasting relationship with Colonial Bank din Alabama. During the period of the real estate bubble in the United States, which has led to the subprime lending crisis, TBW used to grant mortgage loans, and they have already been financed by Colonial Bank. According to the article in FT, the company that manages what is left of the TBW assets are accusing PwC of "failing to spot the conspiracy of several billion dollars between the founder of TBW and the executive management of Colonial Bank". The documents submitted to the court show that PwC signed "clean" audit opinions between 2002 and 2008, and in 2009 Colonial Bank collapsed and "rose" up to the 6th position in the chart of the biggest defaults in the US. The cost for the FDIC (author's note": Federal Deposit Insurance Corp., the institution for the guarantee of bank deposits in the US) was 4.2 billion dollars, according to Bloomberg estimates.

Once upon a time, there were five international audit, tax and audit consulting firms. Arthur Andersen disappeared in 2002, after it was convicted for the involvement in the Enron fraud. Since then, there have been four giants on this market, PricewaterhouseCoopers (PwC), Deloitte Touche Tohmatsu, Ernst & Young and KPMG, and some of their biggest clients are financial institutions. Bloomberg and Financial Times recently wrote that PricewaterhouseCoopers has been sued for "not having detected a case of fraud that led to the collapse of a bank during the global financial crisis". According to FT, the lawsuit in the United States "could bring more audit firms in the line of fire". The biggest lawsuit against an audit firm, according to Financial Times, has been brought following the complaint filed by the company that is in charge of the liquidation of Taylor, Bean & Whitaker (TBW), a mortgage originator in the US, which has been in a long-lasting relationship with Colonial Bank din Alabama. During the period of the real estate bubble in the United States, which has led to the subprime lending crisis, TBW used to grant mortgage loans, and they have already been financed by Colonial Bank. According to the article in FT, the company that manages what is left of the TBW assets are accusing PwC of "failing to spot the conspiracy of several billion dollars between the founder of TBW and the executive management of Colonial Bank". The documents submitted to the court show that PwC signed "clean" audit opinions between 2002 and 2008, and in 2009 Colonial Bank collapsed and "rose" up to the 6th position in the chart of the biggest defaults in the US. The cost for the FDIC (author's note": Federal Deposit Insurance Corp., the institution for the guarantee of bank deposits in the US) was 4.2 billion dollars, according to Bloomberg estimates.Monday, September 19, 2016

A key gauge of credit vulnerability is now three times over the danger threshold and has continued to deteriorate, despite pledges by Chinese premier Li Keqiang to wean the economy off debt-driven growth before it is too late. The Bank for International Settlements warned in its quarterly report that China’s "credit to GDP gap" has reached 30.1, the highest to date and in a different league altogether from any other major country tracked by the institution. It is also significantly higher than the scores in East Asia's speculative boom on 1997 or in the US subprime bubble before the Lehman crisis. Studies of earlier banking crises around the world over the last sixty years suggest that any score above ten requires careful monitoring. The credit to GDP gap measures deviations from normal patterns within any one country and therefore strips out cultural differences. It is based on work the US economist Hyman Minsky and has proved to be the best single gauge of banking risk, although the final denouement can often take longer than assumed. Indicators for what would happen to debt service costs if interest rates rose 250 basis points are also well over the safety line. China’s total credit reached 255pc of GDP at the end of last year, a jump of 107 percentage points over eight years. This is an extremely high level for a developing economy and is still rising fast .

Saturday, September 17, 2016

EU leaders will search for unity at a special summit without the UK on Friday, in the hope of setting a course for a union battered by the Brexit vote and riven by a simmering east-west row over migration. Donald Tusk, the former Polish prime minister who chairs EU leaders’ summits, hopes to cool tempers after Luxembourg’s foreign minister called for Hungary to be thrown out of the EU for allegedly treating asylum seekers “worse than wild animals”. Hungary counterattacked with stinging criticism of the grand duchy’s record in helping big corporations avoid tax. On Thursday Tusk called on EU leaders to take a “brutally honest” look at the bloc’s problems, declaring: “We must not let this crisis go to waste.” “We haven’t come to Bratislava to comfort each other or even worse to deny the real challenges we face in this particular moment in the history of our community after the vote in the UK,” said Tusk, who will chair the summit. “We can’t start our discussion ... with this kind of blissful conviction that nothing is wrong, that everything was and is OK,” he added. “We have to assure ... our citizens that we have learned the lesson from Brexit and we are able to bring back stability and a sense of security and effective protection.” Tusk hopes to focus on areas that the 27 leaders can agree on: border security, counter-terrorism and moves to “to bring back control of globalisation”. Officials are playing down expectations of results from the meeting at Bratislava castle, in the capital of Slovakia, one of the four Visegrád countries along with Poland, Hungary and the Czech Republic. Officials close to Tusk hope for small but symbolic breakthroughs, most notably an agreement to send an extra 200 border guards and 50 vehicles to the EU’s external frontier in Bulgaria by next month. Agreeing on stronger border defences is the easy bit. The thorny issue of sharing the cost of protecting refugees is likely to continue to strain unity. The Visegrád group are fiercely opposed to the EU executive’s attempts to fine them for not accepting refugees in their countries. Hungary has flatly refused to take in refugees under an EU quota scheme, while many other countries are falling short. Hungary’s rightwing prime minister, Viktor Orbán, has called a referendum for 2 October on the EU relocation plan, which would see 1,294 asylum seekers sent to the country. Ahead of the vote, the European commission president, Jean-Claude Juncker, appeared to offer an olive branch to his opponents. In his annual state of the union address, he said solidarity “must come from the heart” and could not be forced.

Friday, September 16, 2016

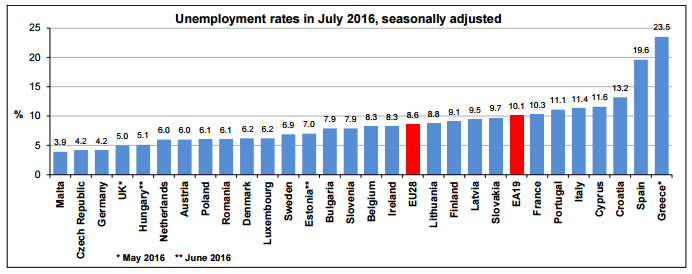

According to Eurostat, in the month of August, the most significant price increases were seem in food, alcohol and cigarettes, which have posted an annual increase of 1.3%, compared to 1.4% in July, followed by services, which have seen an annual increase of 1.1%, compared to 1.2% seen in July. On the other hand, energy prices have seen an annual decrease of 5.7% in August, compared to a decline of 6.7% seen in July. Eurostat had previously announced that in July, compared to June 2016, annual inflation dropped in nine EU member countries, has remained stable in seven countries and has increased in 12 states, including Romania, according to Agerpres. Eurostat has also announced on Wednesday that in July 2016, compared to June 2016, the unemployment rate has remained stable at 10.1% in the Eurozone, while in the European Union the unemployment rate has remained stable at 8.6%. Among the member states, the highest unemployment rates were seen in Greece, (23.5% in May 2016) and Spain (19.6%). On the opposite is Malta, with an unemployment rate of 3.9%, Czech Republic and Germany, both with 4.2%. Romania is below the EU average, with an unemployment rate of 6.1%. Compared to the situation in July 2015, the unemployment rate decreased in 24 member states, including Romania, has remained stable in Denmark and has increased in Estonia, Austria and Belgium. In Romania's case, according to data notified by the National Statistics Institute, (INS), the annual inflation has remained in negative territory in July as well, at -0.8%, down from -0.7% in June. Calculated based on the harmonized consumer price index, the drop has been -0.3%, the INS states. The seasonally adjusted unemployment rate also stood at 6.1%, at the end of July, up 0.1 percentage points over the previous month (6%), according to the standards of the International Labor Bureau.

According to Eurostat, in the month of August, the most significant price increases were seem in food, alcohol and cigarettes, which have posted an annual increase of 1.3%, compared to 1.4% in July, followed by services, which have seen an annual increase of 1.1%, compared to 1.2% seen in July. On the other hand, energy prices have seen an annual decrease of 5.7% in August, compared to a decline of 6.7% seen in July. Eurostat had previously announced that in July, compared to June 2016, annual inflation dropped in nine EU member countries, has remained stable in seven countries and has increased in 12 states, including Romania, according to Agerpres. Eurostat has also announced on Wednesday that in July 2016, compared to June 2016, the unemployment rate has remained stable at 10.1% in the Eurozone, while in the European Union the unemployment rate has remained stable at 8.6%. Among the member states, the highest unemployment rates were seen in Greece, (23.5% in May 2016) and Spain (19.6%). On the opposite is Malta, with an unemployment rate of 3.9%, Czech Republic and Germany, both with 4.2%. Romania is below the EU average, with an unemployment rate of 6.1%. Compared to the situation in July 2015, the unemployment rate decreased in 24 member states, including Romania, has remained stable in Denmark and has increased in Estonia, Austria and Belgium. In Romania's case, according to data notified by the National Statistics Institute, (INS), the annual inflation has remained in negative territory in July as well, at -0.8%, down from -0.7% in June. Calculated based on the harmonized consumer price index, the drop has been -0.3%, the INS states. The seasonally adjusted unemployment rate also stood at 6.1%, at the end of July, up 0.1 percentage points over the previous month (6%), according to the standards of the International Labor Bureau. Wednesday, September 14, 2016

An authoritarian European Commission was to blame for Brexit and must give up on its federalist dreams or risk the disintegration of the European Union, eastern European states have warned as the continent’s divisions were laid bare. “The EU has to change, we have to reform it," the Polish Prime Minister Beata Szydlo told the European Council president, Donald Tusk, at a meeting in Warsaw designed to ensure that post-Brexit Europe could present a united front at a summit in Bratislava on Friday. The east-west split in Warsaw came on the eve of today’s keynote ‘State of the Union’ speech by Jean-Claude Juncker, the European Commission president, which aides had also hoped would provide a “big bang” moment to show that Europe could deliver for ordinary citizens. Instead, European capitals descended into a round of bitter mutual recrimination over the future direction of the continent.

An authoritarian European Commission was to blame for Brexit and must give up on its federalist dreams or risk the disintegration of the European Union, eastern European states have warned as the continent’s divisions were laid bare. “The EU has to change, we have to reform it," the Polish Prime Minister Beata Szydlo told the European Council president, Donald Tusk, at a meeting in Warsaw designed to ensure that post-Brexit Europe could present a united front at a summit in Bratislava on Friday. The east-west split in Warsaw came on the eve of today’s keynote ‘State of the Union’ speech by Jean-Claude Juncker, the European Commission president, which aides had also hoped would provide a “big bang” moment to show that Europe could deliver for ordinary citizens. Instead, European capitals descended into a round of bitter mutual recrimination over the future direction of the continent.Tuesday, September 13, 2016

Hillary Clinton has pneumonia and has been advised to rest, the Democratic presidential nominee’s doctor said on Sunday, after Clinton abruptly left the 9/11 memorial ceremony in downtown Manhattan because, her campaign initially said, she felt “overheated”. On Sunday morning Clinton was helped into a car away from the memorial, where she had been attending a ceremony marking the 15th anniversary of the September 11 attacks. She later travelled to her daughter’s apartment, and eventually to her home in Chappaqua, New York, before her campaign gave a more complete explanation of what had happened. “Secretary Clinton has been experiencing a cough related to allergies,” Dr Lisa R Bardack said in a statement. “On Friday, during follow up evaluation of her prolonged cough, she was diagnosed with pneumonia. She was put on antibiotics, and advised to rest and modify her schedule. “While at this morning’s event, she became overheated and dehydrated. I have just examined her and she is now re-hydrated and recovering nicely.”Clinton left the Ground Zero ceremony after an hour and 30 minutes. Video posted by a bystander to Twitter appeared to show the former secretary of state extremely unsteady and supported by aides, being helped from the curb into a vehicle. A security official who did not wish to be identified told the Guardian Clinton had walked from the ceremony without support, got into a vehicle and been driven away. “She didn’t look great,” he said. “Maybe she was dehydrated. These guys work 16 hours every day.” A statement from campaign spokesman Nick Merrill subsequently said: “Secretary Clinton attended the September 11th Commemoration Ceremony for just an hour and 30 minutes this morning to pay her respects and greet some of the families of the fallen.” Later versions of the statement omitted the word “just”. Merrill added: “During the ceremony, she felt overheated so departed to go to her daughter’s apartment, and is feeling much better.” Clinton’s van and security detail travelled to Chelsea Clinton’s Manhattan apartment, in the Flatiron at 26th and Madison Avenue.

Hillary Clinton has pneumonia and has been advised to rest, the Democratic presidential nominee’s doctor said on Sunday, after Clinton abruptly left the 9/11 memorial ceremony in downtown Manhattan because, her campaign initially said, she felt “overheated”. On Sunday morning Clinton was helped into a car away from the memorial, where she had been attending a ceremony marking the 15th anniversary of the September 11 attacks. She later travelled to her daughter’s apartment, and eventually to her home in Chappaqua, New York, before her campaign gave a more complete explanation of what had happened. “Secretary Clinton has been experiencing a cough related to allergies,” Dr Lisa R Bardack said in a statement. “On Friday, during follow up evaluation of her prolonged cough, she was diagnosed with pneumonia. She was put on antibiotics, and advised to rest and modify her schedule. “While at this morning’s event, she became overheated and dehydrated. I have just examined her and she is now re-hydrated and recovering nicely.”Clinton left the Ground Zero ceremony after an hour and 30 minutes. Video posted by a bystander to Twitter appeared to show the former secretary of state extremely unsteady and supported by aides, being helped from the curb into a vehicle. A security official who did not wish to be identified told the Guardian Clinton had walked from the ceremony without support, got into a vehicle and been driven away. “She didn’t look great,” he said. “Maybe she was dehydrated. These guys work 16 hours every day.” A statement from campaign spokesman Nick Merrill subsequently said: “Secretary Clinton attended the September 11th Commemoration Ceremony for just an hour and 30 minutes this morning to pay her respects and greet some of the families of the fallen.” Later versions of the statement omitted the word “just”. Merrill added: “During the ceremony, she felt overheated so departed to go to her daughter’s apartment, and is feeling much better.” Clinton’s van and security detail travelled to Chelsea Clinton’s Manhattan apartment, in the Flatiron at 26th and Madison Avenue.Monday, September 12, 2016

France’s opposition party will field eight candidates in primaries to decide who will lead it in next year’s presidential election. Polls suggest the winner of the November two-round party vote will become the country’s next leader.

France’s opposition party will field eight candidates in primaries to decide who will lead it in next year’s presidential election. Polls suggest the winner of the November two-round party vote will become the country’s next leader.

After Les Républicains (LR) party nominations closed on Friday evening, the stage was set for a rightwing “duel” between former president Nicolas Sarkozy and former prime minister Alain Juppé, now mayor of Bordeaux.

Polls predict that whoever wins the primary will be in the second-round runoff next May against the Front National’s Marine Le Pen; the latest show Juppé, 71, still the favourite with LR voters, but Sarkozy, 61, snapping at his heels. According to market researchers TNS Sofres, if the election were held tomorrow Juppé would win the second round against Le Pen with 55% of votes, but pollsters agree that former Socialist finance minister Emmanuel Macron could seriously upset the contest if he decides to stand. Macron, an ex-banker, resigned from the Socialist government last month but has not said if he will join the presidential race. Le Figaro suggests he would knock out Sarkozy to take third place.

The only woman among the eight LR candidates, former minister Nathalie Kosciusko-Morizet, 43, is an outside bet.

Sunday, September 11, 2016

Economists at major City investment banks have cancelled forecasts of a Brexit-inspired recession amid fresh data showing the economy performing more robustly than expected. Britain’s trade deficit narrowed significantly in July, as exports increased by £800m to £28.4bn, while imports fell by £300m to £36.6bn. Construction output was also steady in July, faring better than expected a month after the Brexit vote. Goldman Sachs, Morgan Stanley and Credit Suisse are among the major banks that have now withdrawn earlier predictions that Britain is likely to enter recession. Other major banks had forecast a “technical recession” with GDP possibly going negative for two quarters later this year or next. Morgan Stanley initially forecast the economy going negative by 0.4% in the third quarter of 2016, but this week changed that to expectations of 0.3% growth. It said: “We’ve ‘marked-to-market’ our growth forecast from a sharp slowdown and Brecession, to a lesser slowdown, which narrowly avoids a technical recession.” In the days after the vote, Goldman Sachs slashed its growth forecast for the UK by 2.5% over two years. Its chief European economist, Huw Pill, said on 27 June that there would be “a steep fall in activity” as he predicted a “mild recession by early 2017”. Pill said this week: “The downturn in the UK – while still substantial – is likely to be shallower than we thought in the immediate aftermath of the referendum.” Goldman Sachs is now pencilling in UK growth of 0.9% in 2017.

Economists at major City investment banks have cancelled forecasts of a Brexit-inspired recession amid fresh data showing the economy performing more robustly than expected. Britain’s trade deficit narrowed significantly in July, as exports increased by £800m to £28.4bn, while imports fell by £300m to £36.6bn. Construction output was also steady in July, faring better than expected a month after the Brexit vote. Goldman Sachs, Morgan Stanley and Credit Suisse are among the major banks that have now withdrawn earlier predictions that Britain is likely to enter recession. Other major banks had forecast a “technical recession” with GDP possibly going negative for two quarters later this year or next. Morgan Stanley initially forecast the economy going negative by 0.4% in the third quarter of 2016, but this week changed that to expectations of 0.3% growth. It said: “We’ve ‘marked-to-market’ our growth forecast from a sharp slowdown and Brecession, to a lesser slowdown, which narrowly avoids a technical recession.” In the days after the vote, Goldman Sachs slashed its growth forecast for the UK by 2.5% over two years. Its chief European economist, Huw Pill, said on 27 June that there would be “a steep fall in activity” as he predicted a “mild recession by early 2017”. Pill said this week: “The downturn in the UK – while still substantial – is likely to be shallower than we thought in the immediate aftermath of the referendum.” Goldman Sachs is now pencilling in UK growth of 0.9% in 2017.Saturday, September 10, 2016

Eurostat has issued a publication to inform regarding the unemployment rate in Euro area for July.The euro area (EA19) seasonally-adjusted unemployment rate was 10.1% in July 2016, stable compared to June 2016 and down from 10.8% in July 2015. This remains the lowest rate recorded in the euro area since July 2011. The EU28 unemployment rate was 8.6% in July 2016, stable compared to June 2016 and down from 9.4% in July 2015. This remains the lowest rate recorded in the EU28 since March 2009. These figures are published by Eurostat, the statistical office of the European Union. Eurostat estimates that 21.063 million men and women in the EU28, of whom 16.307 million were in the euro area, were unemployed in July 2016. Compared with June 2016, the number of persons unemployed decreased by 29 000 in the EU28 and by 43 000 in the euro area. Compared with July 2015, unemployment fell by 1.688 million in the EU28 and by 1.034 million in the euro area.

Eurostat has issued a publication to inform regarding the unemployment rate in Euro area for July.The euro area (EA19) seasonally-adjusted unemployment rate was 10.1% in July 2016, stable compared to June 2016 and down from 10.8% in July 2015. This remains the lowest rate recorded in the euro area since July 2011. The EU28 unemployment rate was 8.6% in July 2016, stable compared to June 2016 and down from 9.4% in July 2015. This remains the lowest rate recorded in the EU28 since March 2009. These figures are published by Eurostat, the statistical office of the European Union. Eurostat estimates that 21.063 million men and women in the EU28, of whom 16.307 million were in the euro area, were unemployed in July 2016. Compared with June 2016, the number of persons unemployed decreased by 29 000 in the EU28 and by 43 000 in the euro area. Compared with July 2015, unemployment fell by 1.688 million in the EU28 and by 1.034 million in the euro area.

Member States

Among the Member States, the lowest unemployment rates in July 2016 were recorded in Malta (3.9%) as well as in the Czech Republic and Germany (both 4.2%). The highest unemployment rates were observed in Greece (23.5% in May 2016) and Spain (19.6%). Compared with a year ago, the unemployment rate in July 2016 fell in twenty-four Member States, remained stable in Denmark, while it increased in Estonia (from 6.1% to 7.0% between June 2015 and June 2016), Austria (from 5.7% to 6.0%) and Belgium (from 8.1% to 8.3%). The largest decreases were registered in Cyprus (from 15.0% to 11.6%), Croatia (from 16.5% to 13.2%) and Spain (from 21.9% to 19.6%). In July 2016, the unemployment rate in the United States was 4.9%, stable compared to June 2016 and down from 5.3% in July 2015.

Youth unemployment

In July 2016, 4.276 million young persons (under 25) were unemployed in the EU28, of whom 2.969 million were in the euro area. Compared with July 2015, youth unemployment decreased by 310 000 in the EU28 and by 136 000 in the euro area. In July 2016, the youth unemployment rate was 18.8% in the EU28 and 21.1% in the euro area, compared with 20.2% and 22.1% respectively in July 2015. In July 2016, the lowest rates were observed in Malta (7.1%) and Germany (7.2%), and the highest in Greece (50.3% in May 2016), Spain (43.9%) and Italy (39.2%).

Geographical information

The euro area (EA19) includes Belgium, Germany, Estonia, Ireland, Greece, Spain, France, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Austria, Portugal, Slovenia, Slovakia and Finland. The European Union (EU28) includes Belgium, Bulgaria, the Czech Republic, Denmark, Germany, Estonia, Ireland, Greece, Spain, France, Croatia, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Hungary, Malta, the Netherlands, Austria, Poland, Portugal, Romania, Slovenia, Slovakia, Finland, Sweden and the United Kingdom.

Methods and definition

Eurostat produces harmonised unemployment rates for individual EU Member States, the euro area and the EU. These unemployment rates are based on the definition recommended by the International Labour Organisation (ILO). The measurement is based on a harmonised source, the European Union Labour Force Survey (LFS).

Based on the ILO definition, Eurostat defines unemployed persons as persons aged 15 to 74 who:

- are without work;

- are available to start work within the next two weeks;

- and have actively sought employment at some time during the previous four weeks.

- are without work;

- are available to start work within the next two weeks;

- and have actively sought employment at some time during the previous four weeks.

The unemployment rate is the number of people unemployed as a percentage of the labour force. The labour force is the total number of people employed plus unemployed. In this news release unemployment rates are based on employment and unemployment data covering persons aged 15 to 74. The youth unemployment rate is the number of people aged 15 to 24 unemployed as a percentage of the labour force of the same age. Therefore, the youth unemployment rate should not be interpreted as the share of jobless people in the overall youth population.

Country notes

Germany, the Netherlands, Austria, Finland, Sweden and Iceland: the trend component is used instead of the more volatile seasonally adjusted data. Denmark, Estonia, Hungary, Portugal, the United Kingdom and Norway: 3-month moving averages of LFS data are used instead of pure monthly indicators.

Friday, September 9, 2016

US president Barack Obama holds a joint press conference with prime minister Theresa May ahead of the G20 summit in Hangzhou on Sunday. Speaking of the consequences of Britain’s decision to leave the EU, Obama says that, while he still believes that the world “benefitted enormously” from the UK’s membership of the European Union, he would work with May to ensure the consequences of the vote “don’t end up unravelling” the strong trade relationship between the two nations

Wednesday, September 7, 2016

The annual inflation rate in the Eurozone has remained stable in August compared to July, at 0.2%, according to a preliminary estimate published on Wednesday by the European Statistics Office (Eurostat). According to Eurostat, in the month of August, the most significant price increases were seem in food, alcohol and cigarettes, which have posted an annual increase of 1.3%, compared to 1.4% in July, followed by services, which have seen an annual increase of 1.1%, compared to 1.2% seen in July. On the other hand, energy prices have seen an annual decrease of 5.7% in August, compared to a decline of 6.7% seen in July. Eurostat had previously announced that in July, compared to June 2016, annual inflation dropped in nine EU member countries, has remained stable in seven countries and has increased in 12 states, including Romania, according to Agerpres. Eurostat has also announced on Wednesday that in July 2016, compared to June 2016, the unemployment rate has remained stable at 10.1% in the Eurozone, while in the European Union the unemployment rate has remained stable at 8.6%. Among the member states, the highest unemployment rates were seen in Greece, (23.5% in May 2016) and Spain (19.6%). On the opposite is Malta, with an unemployment rate of 3.9%, Czech Republic and Germany, both with 4.2%. Romania is below the EU average, with an unemployment rate of 6.1%. Compared to the situation in July 2015, the unemployment rate decreased in 24 member states, including Romania, has remained stable in Denmark and has increased in Estonia, Austria and Belgium. In Romania's case, according to data notified by the National Statistics Institute, (INS), the annual inflation has remained in negative territory in July as well, at -0.8%, down from -0.7% in June. Calculated based on the harmonized consumer price index, the drop has been -0.3%, the INS states. The seasonally adjusted unemployment rate also stood at 6.1%, at the end of July, up 0.1 percentage points over the previous month (6%), according to the standards of the International Labor Bureau.

Tuesday, September 6, 2016

Wall Street drew two conclusions from the news that the US jobs engine shifted down into a lower gear last month. The first – that a September increase in interest rates is now a non-starter – was almost certainly right. Putting up the cost of borrowing so close to the presidential election in early November always looked like an outside bet. It would have taken thunderously good figures for job creation to have persuaded the more dove-ish policymakers at the Federal Reserve to move, and the ones released on Friday were average at best. To be sure, the August non-farm payrolls have come in worse than expected for the past decade, suggesting that there might be some problem with the way the raw data is seasonally adjusted. What’s more, the two previous months – June and July – saw strong increases in demand for labour, so the three-month average for non-farm payrolls is running at a healthy 200,000. That could persuade some of the hawks at the Fed to move, but they will not be able to muster a majority. The second conclusion drawn by Wall Street is more questionable. That is the assumption that the rate rise some analysts had pencilled in for September has now simply been put back to a later date. Some economists believe the Fed won’t waste any time once US voters have chosen who will be Barack Obama’s successor at the White House; some think the central bank will wait until March next year. There is, though, a different way of looking at the numbers. For most of this year, the strength of the US labour market has been at odds with data showing the economy growing only slowly. Sooner or later, the theory went, growth would accelerate and come into line with employment numbers, so justifying higher interest rates.

Wall Street drew two conclusions from the news that the US jobs engine shifted down into a lower gear last month. The first – that a September increase in interest rates is now a non-starter – was almost certainly right. Putting up the cost of borrowing so close to the presidential election in early November always looked like an outside bet. It would have taken thunderously good figures for job creation to have persuaded the more dove-ish policymakers at the Federal Reserve to move, and the ones released on Friday were average at best. To be sure, the August non-farm payrolls have come in worse than expected for the past decade, suggesting that there might be some problem with the way the raw data is seasonally adjusted. What’s more, the two previous months – June and July – saw strong increases in demand for labour, so the three-month average for non-farm payrolls is running at a healthy 200,000. That could persuade some of the hawks at the Fed to move, but they will not be able to muster a majority. The second conclusion drawn by Wall Street is more questionable. That is the assumption that the rate rise some analysts had pencilled in for September has now simply been put back to a later date. Some economists believe the Fed won’t waste any time once US voters have chosen who will be Barack Obama’s successor at the White House; some think the central bank will wait until March next year. There is, though, a different way of looking at the numbers. For most of this year, the strength of the US labour market has been at odds with data showing the economy growing only slowly. Sooner or later, the theory went, growth would accelerate and come into line with employment numbers, so justifying higher interest rates.Monday, September 5, 2016

The annual inflation rate in the Eurozone has remained stable in August compared to July, at 0.2%, according to a preliminary estimate published on Wednesday by the European Statistics Office (Eurostat). According to Eurostat, in the month of August, the most significant price increases were seem in food, alcohol and cigarettes, which have posted an annual increase of 1.3%, compared to 1.4% in July, followed by services, which have seen an annual increase of 1.1%, compared to 1.2% seen in July. On the other hand, energy prices have seen an annual decrease of 5.7% in August, compared to a decline of 6.7% seen in July. Eurostat had previously announced that in July, compared to June 2016, annual inflation dropped in nine EU member countries, has remained stable in seven countries and has increased in 12 states, including Romania, according to Agerpres. Eurostat has also announced on Wednesday that in July 2016, compared to June 2016, the unemployment rate has remained stable at 10.1% in the Eurozone, while in the European Union the unemployment rate has remained stable at 8.6%. Among the member states, the highest unemployment rates were seen in Greece, (23.5% in May 2016) and Spain (19.6%). On the opposite is Malta, with an unemployment rate of 3.9%, Czech Republic and Germany, both with 4.2%. Romania is below the EU average, with an unemployment rate of 6.1%. Compared to the situation in July 2015, the unemployment rate decreased in 24 member states, including Romania, has remained stable in Denmark and has increased in Estonia, Austria and Belgium. In Romania's case, according to data notified by the National Statistics Institute, (INS), the annual inflation has remained in negative territory in July as well, at -0.8%, down from -0.7% in June. Calculated based on the harmonized consumer price index, the drop has been -0.3%, the INS states. The seasonally adjusted unemployment rate also stood at 6.1%, at the end of July, up 0.1 percentage points over the previous month (6%), according to the standards of the International Labor Bureau.

The annual inflation rate in the Eurozone has remained stable in August compared to July, at 0.2%, according to a preliminary estimate published on Wednesday by the European Statistics Office (Eurostat). According to Eurostat, in the month of August, the most significant price increases were seem in food, alcohol and cigarettes, which have posted an annual increase of 1.3%, compared to 1.4% in July, followed by services, which have seen an annual increase of 1.1%, compared to 1.2% seen in July. On the other hand, energy prices have seen an annual decrease of 5.7% in August, compared to a decline of 6.7% seen in July. Eurostat had previously announced that in July, compared to June 2016, annual inflation dropped in nine EU member countries, has remained stable in seven countries and has increased in 12 states, including Romania, according to Agerpres. Eurostat has also announced on Wednesday that in July 2016, compared to June 2016, the unemployment rate has remained stable at 10.1% in the Eurozone, while in the European Union the unemployment rate has remained stable at 8.6%. Among the member states, the highest unemployment rates were seen in Greece, (23.5% in May 2016) and Spain (19.6%). On the opposite is Malta, with an unemployment rate of 3.9%, Czech Republic and Germany, both with 4.2%. Romania is below the EU average, with an unemployment rate of 6.1%. Compared to the situation in July 2015, the unemployment rate decreased in 24 member states, including Romania, has remained stable in Denmark and has increased in Estonia, Austria and Belgium. In Romania's case, according to data notified by the National Statistics Institute, (INS), the annual inflation has remained in negative territory in July as well, at -0.8%, down from -0.7% in June. Calculated based on the harmonized consumer price index, the drop has been -0.3%, the INS states. The seasonally adjusted unemployment rate also stood at 6.1%, at the end of July, up 0.1 percentage points over the previous month (6%), according to the standards of the International Labor Bureau.Sunday, September 4, 2016

Hiring in the US slowed in August following a summer surge in a sign that the Federal Reserve will hold off on raising interest rates this month. Employers added 151,000 staff to their payrolls last month, according to the US Labor Department. This was below the 180,000 expected by analysts, and down from an upwardly revised increase of 275,000 in July. The steady jobs growth kept the unemployment rate at 4.9pc. Economists expected the rate to fall to 4.8pc. The dollar fell against the pound and the euro after the data were released, while traders reduced their bets on a September rate hike. Financial markets now believe there is a 26pc that the Fed will raise rates this month, down from 34pc just before the jobs data were released. The probability of a rate hike this year fell to 56pc, from 60pc.... Janet Yellen, the chairman of the Federal Reserve, said last week that she believed that the case for raising interest rates in the world’s largest economy was strengthening. Stanley Fischer, vice chairman of the Fed, signalled that two rate increases were possible, though Ms Yellen and Mr Fischer stressed that any move up from the current federal funds target of between 0.25pc and 0.5pc would depend on the data they saw. The average monthly jobs gain over the past 12 months has been 204,000. Separate US data showed the trade deficit narrowed in July as exports rose to their highest level in 10 months. This suggests economic growth picked up at the start of the third quarter following annualised growth of 1.1pc in the second quarter.

Hiring in the US slowed in August following a summer surge in a sign that the Federal Reserve will hold off on raising interest rates this month. Employers added 151,000 staff to their payrolls last month, according to the US Labor Department. This was below the 180,000 expected by analysts, and down from an upwardly revised increase of 275,000 in July. The steady jobs growth kept the unemployment rate at 4.9pc. Economists expected the rate to fall to 4.8pc. The dollar fell against the pound and the euro after the data were released, while traders reduced their bets on a September rate hike. Financial markets now believe there is a 26pc that the Fed will raise rates this month, down from 34pc just before the jobs data were released. The probability of a rate hike this year fell to 56pc, from 60pc.... Janet Yellen, the chairman of the Federal Reserve, said last week that she believed that the case for raising interest rates in the world’s largest economy was strengthening. Stanley Fischer, vice chairman of the Fed, signalled that two rate increases were possible, though Ms Yellen and Mr Fischer stressed that any move up from the current federal funds target of between 0.25pc and 0.5pc would depend on the data they saw. The average monthly jobs gain over the past 12 months has been 204,000. Separate US data showed the trade deficit narrowed in July as exports rose to their highest level in 10 months. This suggests economic growth picked up at the start of the third quarter following annualised growth of 1.1pc in the second quarter.

Subscribe to:

Posts (Atom)