Confidence among shoppers in Germany has dipped according to a survey, amid worries over Europe's largest economy. The forward-looking GfK consumer sentiment indicator fell to 9.3 points for December from 9.4 points in the previous month. The score is the lowest since February, but was above analysts' predictions. Confidence in the economy among German consumers dropped for the sixth consecutive month, although the pace reduced. Concern about the labour market led the way, according to the survey of 2,000 shoppers, with 69% of all those surveyed expecting an increase in unemployment due to the influx of asylum seekers this year. This month's survey was conducted before the attacks in Paris on 13 November. In contrast to general sentiment, optimism for making a big purchase improved, with the sub-index for willingness to buy climbing by three points to 48.9.

Confidence among shoppers in Germany has dipped according to a survey, amid worries over Europe's largest economy. The forward-looking GfK consumer sentiment indicator fell to 9.3 points for December from 9.4 points in the previous month. The score is the lowest since February, but was above analysts' predictions. Confidence in the economy among German consumers dropped for the sixth consecutive month, although the pace reduced. Concern about the labour market led the way, according to the survey of 2,000 shoppers, with 69% of all those surveyed expecting an increase in unemployment due to the influx of asylum seekers this year. This month's survey was conducted before the attacks in Paris on 13 November. In contrast to general sentiment, optimism for making a big purchase improved, with the sub-index for willingness to buy climbing by three points to 48.9.

Showing posts with label Media Trust. Show all posts

Showing posts with label Media Trust. Show all posts

Sunday, October 1, 2017

Saturday, December 5, 2015

Confidence among shoppers in Germany has dipped according to a survey, amid worries over Europe's largest economy. The forward-looking GfK consumer sentiment indicator fell to 9.3 points for December from 9.4 points in the previous month. The score is the lowest since February, but was above analysts' predictions. Confidence in the economy among German consumers dropped for the sixth consecutive month, although the pace reduced. Concern about the labour market led the way, according to the survey of 2,000 shoppers, with 69% of all those surveyed expecting an increase in unemployment due to the influx of asylum seekers this year. This month's survey was conducted before the attacks in Paris on 13 November. In contrast to general sentiment, optimism for making a big purchase improved, with the sub-index for willingness to buy climbing by three points to 48.9.

Confidence among shoppers in Germany has dipped according to a survey, amid worries over Europe's largest economy. The forward-looking GfK consumer sentiment indicator fell to 9.3 points for December from 9.4 points in the previous month. The score is the lowest since February, but was above analysts' predictions. Confidence in the economy among German consumers dropped for the sixth consecutive month, although the pace reduced. Concern about the labour market led the way, according to the survey of 2,000 shoppers, with 69% of all those surveyed expecting an increase in unemployment due to the influx of asylum seekers this year. This month's survey was conducted before the attacks in Paris on 13 November. In contrast to general sentiment, optimism for making a big purchase improved, with the sub-index for willingness to buy climbing by three points to 48.9.

GfK analyst Rolf Buerkl said he was optimistic for this year's Christmas sales, as customers might be tempted to shop online if they are concerned for public safety. "It is possible that a few people here and there will avoid going to the Christmas market or visiting a shopping mall," Mr Buerkl said.

Friday, October 30, 2015

"We are open to a whole menu of monetary policy instruments," Mr Draghi said, noting that further interest rate cuts had been discussed. "The discussion was wide open."" Sounds like he has Yellen's Disease, but printing money is always the solution for the left to fix fiscal abnormalities... “The ECB will almost certainly be delivering an early Christmas present this year,” said Nick Kounis, the head of markets and macro research at investment bank ABN Amro. Draghi is an enthusiastic proponent of “forward guidance”, the strategy of sending strong verbal policy signals in order to shift financial markets – in this case, driving down the euro. His dramatic pledge in the summer of 2012 – in the middle of the Greek debt crisis – that the ECB would do “whatever it takes” to save the single currency helped to reassure panic-stricken investors. Jeremy Cook, the chief economist of international payments company World First, said ECB policymakers were likely to have become increasingly concerned in recent weeks about the strengthening of the currency, which makes eurozone goods less competitive on international markets. “Draghi and the executive council couldn’t have been clearer that additional policy easing was coming if they’d had the words ‘sell the euro’ tattooed on their faces,” he said. Euro area GDP rose 0.4% in the second quarter of 2015, a slight slowdown from 0.5% growth in the previous quarter. We must all call attention to the salient fact that the EU, US, UK and Japan are riding along using debt to sustain their economies. QE and other nostrums directly related to money printing thus monetizing the debt must be clearly understood...A number of reasons they do this:

1) kicking the can in the hope some visionary guides us to economic enlightenment before the global economy implodes in it's entirety

2) this is simply a response to the US' decision not to raise rates as well as the Yuan's devaluation a number of months ago. Given the Euro depends on exports, a weaker Euro will prop up the currency. Make no mistake, we're at war, a currency war

3) this is also being pushed as a solution by those who seek to gain the most, ie banks and investment funds. Governments in the aforementioned states are too large and expensive, too inefficient, too prone to spend without consideration of how the debt is affected by the deficits and too prone to call for more taxation in every case where they run short of money.So now it is completely safe to say that the relationship between stocks and underlying fundamentals now NO LONGER EXISTS.

No if's, no maybe's, just absolute fact. Stock valuations are entire fiction. The entire purpose of the Fed / ECB / BoE/ BoJ is to make something levitate. What they cannot do is make anyone with a brain believe a word of it. It is almost game over, pension fund over, banking system over, savings over. Quantitative easing is not the answer, reality is the answer. Let's just accept that our standard of living is going to fall. QE will delay it and make matters worse, facing reality on the other hand will ensure that the fall in our standard of living will happen now, but won't be as painful in the future when compared to the QE option. The reality is - Too much debt

One of the three following options are open to the central planners.

1. QE for as long as possible - outcome - Dreadful economic future.

2. Attempt to reduce the deficit to zero by the end of this Parliament. - outcome - significant reduction of our standard of living and civil unrest.

3. Attempt to reduce the deficit over a long period of time, bearing in mind the paradox of thrift will make this a slow and relatively painful process, but from my point of view, this is the best option open to us. A tipping point passed many years ago, we needed brave politicians dealing with the debt issue. However. I can understand why politicians did not grasp the nettle, a fickle public would not vote for them, after all, who wants harsh reality.

Thursday, October 1, 2015

Useless, useless, useless - Germans have "Dachau and such" ready !!!!

Blowing hot air = UK Prime Minister David Cameron spoke of a comprehensive approach; Viktor Orban, the normally fiery Hungarian leader told me everyone had to co-operate and Angela Merkel insisted, "What we cannot say is Europe cannot deal with this. I say it again and again, we WILL do this!"

Blowing hot air = UK Prime Minister David Cameron spoke of a comprehensive approach; Viktor Orban, the normally fiery Hungarian leader told me everyone had to co-operate and Angela Merkel insisted, "What we cannot say is Europe cannot deal with this. I say it again and again, we WILL do this!"

EU leaders do actually agree on a number of key issues:

- Cracking down on people smuggling rings

- Getting asylum claims processed faster, so failed claimants can be deported more rapidly

- The need to secure Europe's external borders

- Boosting aid to the sprawling, squalid refugee camps around Syria, so fewer people feel tempted to come to Europe

- Stepping up attempts to try to end the war in Syria

But common resolve is one thing. Effective, immediate action is quite another. And some of the leaders' goals are more realistic than others. At a press conference after the summit, the German chancellor spoke of the need to talk to Syria's President Bashar al-Assad as part of a new European push for peace in his country. The conflict has now reached Europe, and Germany in particular. It is the European country of choice for Syrian refugees. In the past, Germany has joined other Western leaders in calling for President Assad to step aside. So these talks would be delicate and controversial, they will not happen overnight and their chances of success are limited, to say the least. Then there's the question of building what is often dubbed Fortress Europe - or what Donald Tusk described last night as "closing Europe's doors and windows".

Thursday, March 12, 2015

Don't forget Target2! Germany is going to take a cold shower of 70-80 billion Euros if there is a Grexit. More worrying Italy and France are up for 10's of billions as well. So it's not exactly a picnic!... Bundesbank's TARGET2 exposure

Don't forget Target2! Germany is going to take a cold shower of 70-80 billion Euros if there is a Grexit. More worrying Italy and France are up for 10's of billions as well. So it's not exactly a picnic!... Bundesbank's TARGET2 exposureAmount: EUR 513,365,579,273.88

(As at: 28 February 2015)

I think this whole charade may well simply be about buying time for the "made men" of the Brussels Mafia to settle THEIR creditors and bankers down enough to accept a Greek default and exit and to come up with a creditable excuse that claims the EU is intact and the euro is under no threat ... I've just read Varoufakis's six proposals for negotiation in Brussels next week, and they can be summarised as bla-de-bla-de-bla. In any serious discussion they'd get short shrift. With Juncker there trying to be Greeker than the Greeks, all moral hazard will be blown to bits. So Juncker needs to be told his business is to stay away, shut up, and stop meddling - otherwise his own past 'activities' in Luxemburg will be brought to light...I really don't think the EZ should allow Greek pension funds to be raided, or the ECB or EZ to provide cash for Greece to pay the IMF - the money would never be returned, and it would be an added burden for future taxpayers. Let us help Greece into an orderly default, grexit from the euro, and the care of the IMF, with vaguely benign promises of rehabilitation 'as and when' ... This could be the final meltdown of the global ponzi scheme that's being going on for over a century. Then all these people who think they are rich will realise that the money they thought they were owed will never be repaid. The UK and the US didn't avert the collapse of the world's financial systems in 2008, they just postponed it and the imbalances have only got much bigger. If creditors and saver think they're having it tough right now, they ain't seen nothin' yet !

Tuesday, February 10, 2015

Greece and Germany are on the frontline in a fierce battle about the future of European economic policy, with Syriza determined to show that ditching austerity is a better recipe for economic recovery than relentless cuts, and Germany determined to make Athens stick to the deficit-cutting agenda – and pay back the €240bn (£180bn) in bailout loans it received from the international community. As Varoufakis returned to Athens , thousands of people gathered on the streets to show solidarity in the party’s battle with Greece’s creditors. The fresh outpouring of public concern, with protesters gathering in Syntagma Square, the centre of anti-government riots during repeated crises in recent years, came after the European Central Bank outraged policymakers by restricting access to emergency funds for Greece’s struggling banks. In Berlin, Varoufakis promised to meet the alarmist warnings of some in the eurozone about the consequences of Syriza’s radical policies with “a frenzy of reasonableness”. Just before the Berlin meeting the Russian president, Vladimir Putin, had ratcheted up the pressure on the eurozone to find a solution to the crisis by inviting the new Greek prime minister, Alexis Tsipras, to talks in Moscow in May. Schäuble said Germany would “fully respect the mandate” handed to Varoufakis and his colleagues by the electorate in the general election last month, but Germany had its own democratic pressures.

Tuesday, January 20, 2015

Crude dropped to its lowest since April 2009 in the wake of a glut of supply, triggering more swings in share prices after heavy falls on Monday. At one point Brent crude fell 2 per cent to $51.23 a barrel and US crude dropped nearly 3 per cent to $48.47, adding to market worries about a possible Greek exit from the euro. The UK's FTSE 100 index of leading shares plunged as much as 78 points, after a 130 point drop on the previous day, before staging an afternoon rally to close down 50.7 points to 6366.5 points. Shares in Germany and France were also under pressure, as Wall Street fell 141 points in early trading following Monday's 331 point slump. Oil prices have been driven lower by a combination of higher US shale gas and oil production and a refusal by Saudi Arabia to cut output. Alastair McCaig, analyst at broker IG, said: "Commodity prices continue to play havoc with the FTSE." Despite market volatility, chief European economist Jonathan Loynes at Capital Economics predicted UK economic prospects would be improved by lower energy costs which would hold down inflation.

Crude dropped to its lowest since April 2009 in the wake of a glut of supply, triggering more swings in share prices after heavy falls on Monday. At one point Brent crude fell 2 per cent to $51.23 a barrel and US crude dropped nearly 3 per cent to $48.47, adding to market worries about a possible Greek exit from the euro. The UK's FTSE 100 index of leading shares plunged as much as 78 points, after a 130 point drop on the previous day, before staging an afternoon rally to close down 50.7 points to 6366.5 points. Shares in Germany and France were also under pressure, as Wall Street fell 141 points in early trading following Monday's 331 point slump. Oil prices have been driven lower by a combination of higher US shale gas and oil production and a refusal by Saudi Arabia to cut output. Alastair McCaig, analyst at broker IG, said: "Commodity prices continue to play havoc with the FTSE." Despite market volatility, chief European economist Jonathan Loynes at Capital Economics predicted UK economic prospects would be improved by lower energy costs which would hold down inflation. Wednesday, November 5, 2014

Global shadow banking assets rose to a record $75 trillion (£46.5 trillion) last year, new analysis shows. The value of risky investment products, mortgage-backed securities and other non-bank entities increased by $5 trillion to $75 trillion in 2013, according to the Financial Stability Board (FSB). Shadow banking, which is not constrained by bank regulation, now represents about 25pc of total financial assets - or roughly half of the global banking system. It is also equivalent to 120pc of global gross domestic product (GDP). The FSB, which monitors and makes recommendations on financial stability issues, said that while non-bank lending complemented traditional channels by expanding access to credit, data inconsistencies together with the size of the system meant closer monitoring was warranted. "Intermediating credit through non-bank channels can have important advantages and contributes to the financing of the real economy; but such channels can also become a source of systemic risk, especially when they are structured to perform bank-like functions and when their interconnectedness with the regular banking system is strong," the FSB said in its annual shadow banking report.

Global shadow banking assets rose to a record $75 trillion (£46.5 trillion) last year, new analysis shows. The value of risky investment products, mortgage-backed securities and other non-bank entities increased by $5 trillion to $75 trillion in 2013, according to the Financial Stability Board (FSB). Shadow banking, which is not constrained by bank regulation, now represents about 25pc of total financial assets - or roughly half of the global banking system. It is also equivalent to 120pc of global gross domestic product (GDP). The FSB, which monitors and makes recommendations on financial stability issues, said that while non-bank lending complemented traditional channels by expanding access to credit, data inconsistencies together with the size of the system meant closer monitoring was warranted. "Intermediating credit through non-bank channels can have important advantages and contributes to the financing of the real economy; but such channels can also become a source of systemic risk, especially when they are structured to perform bank-like functions and when their interconnectedness with the regular banking system is strong," the FSB said in its annual shadow banking report.

Ultimately some of this money leaks into physical assets and we will see tremendous inflation and asset bubbles. The money creation is all being retained in the banking system whilst M2 money supply is crashing to record lows. All the economic meters are going into the red except GDP growth because that is funded by debt funded by money printing which is fueling the distortion in our financial system. Even the IMF is ringing the fire alarm.

Economically this is a fascinating experiment with FIAT money which has not been around that long compared to its predecessor (asset backed currency) invented by Sir Isaac Newton as Master of the Royal Mint. This shadow is 120% of Global GDP haha and `no systemic risk`. They just type figures into a computer and call it money. No one understands this and no one can explain what it means... It`s like trying to regulate the Sun while flying like Icarus...Granular data from 23 countries which stripped out assets not related to credit intermediation - or taking money from savers and lending it to borrowers - showed the size of the shadow banking system stood at $34.9 trillion in 2013, compared with $34 trillion in 2012. Under this measure, growth of shadow banking in China was even larger than under the headline measure, rising by 40pc in 2013 to $2.7 trillion. The FSB data follows a report by the International Monetary Fund this month which urged regulators to do more to police activity in the non-bank sector. The FSB and IMF said more data were needed to conduct in-depth healthchecks of the sector.

Economically this is a fascinating experiment with FIAT money which has not been around that long compared to its predecessor (asset backed currency) invented by Sir Isaac Newton as Master of the Royal Mint. This shadow is 120% of Global GDP haha and `no systemic risk`. They just type figures into a computer and call it money. No one understands this and no one can explain what it means... It`s like trying to regulate the Sun while flying like Icarus...Granular data from 23 countries which stripped out assets not related to credit intermediation - or taking money from savers and lending it to borrowers - showed the size of the shadow banking system stood at $34.9 trillion in 2013, compared with $34 trillion in 2012. Under this measure, growth of shadow banking in China was even larger than under the headline measure, rising by 40pc in 2013 to $2.7 trillion. The FSB data follows a report by the International Monetary Fund this month which urged regulators to do more to police activity in the non-bank sector. The FSB and IMF said more data were needed to conduct in-depth healthchecks of the sector.

Wednesday, September 3, 2014

Thieves covering for thives ...

The executive board of the International Monetary Fund has expressed confidence in its managing director, Christine Lagarde, after receiving a briefing on a French corruption investigation.

The executive board of the International Monetary Fund has expressed confidence in its managing director, Christine Lagarde, after receiving a briefing on a French corruption investigation.

In a brief statement, the 24-member board said it continued to have “confidence in the managing director’s ability to effectively carry out her duties”. Lagarde called the investigation “without basis” after answering questions before magistrates in Paris on Wednesday. She and her former chief of staff are facing questions about their role in an arbitration ruling that handed 400m euros ($531m) to the French businessman Bernard Tapie.

Tapie had sued the French bank Credit Lyonnais for its handling of the sale of his majority stake in the sportswear company Adidas in the mid-1990s. In its statement, the IMF board said, “It would not be appropriate to comment on a case that has been and is currently before the French judiciary.”

In her statement on Wednesday, Lagarde said that after three years of proceedings and dozens of hours of questioning, the court had found no evidence that she had done anything wrong and that the only remaining allegation “is that I was not sufficiently vigilant”.

She said she was returning to Washington and her work at the IMF.

Under French law, the action to put Lagarde under official investigation is equivalent to a preliminary charge, which means there is reason to suspect an infraction. Investigating judges can later decide to drop the case or issue a formal charge and send the matter to trial.

Wednesday, June 25, 2014

MOSCOW — The French are sending Russia advanced helicopter

carriers. Germans built it a high-tech military training facility. Italians have

been shipping armored vehicles. Deep into a crisis in which Russia’s military

deployed on Ukrainian soil, European nations are struggling to balance economic

considerations with political ones. Now France is poised this month to invite

400 Russian sailors to train on a massive new ship that a Russian admiral once

said would have enabled his nation to beat neighboring Georgia in its 2008 war

in “40 minutes instead of 26 hours.” French leaders have refused to cancel the

$1.7 billion sale of two Mistral-class helicopter carriers — capable of

transporting 16 attack helicopters, dozens of tanks and 700 soldiers — despite

Russia’s recent aggression, including its annexation of the Crimean Peninsula in

March. The plans have drawn condemnation from allies including the United States

and NATO, which say that supplying military equipment to Russia with one hand

while condemning its military actions with the other is clearly contradictory.

The Mistral deal and other arms shipments lay bare the difficulty of applying

pressure on Russia, even at a time when tensions between the West and Russia are

at their worst since the Cold War. European leaders have sought to protect

their defense industries even as they have sanctioned Russian officials over the

Crimea annexation. “We are executing the contract in full legal compliance

because we’ re not at that level of sanctions,” French President François

Hollande told reporters this month. If sanctions escalate, he said, France may

hold back on sending the ships.

MOSCOW — The French are sending Russia advanced helicopter

carriers. Germans built it a high-tech military training facility. Italians have

been shipping armored vehicles. Deep into a crisis in which Russia’s military

deployed on Ukrainian soil, European nations are struggling to balance economic

considerations with political ones. Now France is poised this month to invite

400 Russian sailors to train on a massive new ship that a Russian admiral once

said would have enabled his nation to beat neighboring Georgia in its 2008 war

in “40 minutes instead of 26 hours.” French leaders have refused to cancel the

$1.7 billion sale of two Mistral-class helicopter carriers — capable of

transporting 16 attack helicopters, dozens of tanks and 700 soldiers — despite

Russia’s recent aggression, including its annexation of the Crimean Peninsula in

March. The plans have drawn condemnation from allies including the United States

and NATO, which say that supplying military equipment to Russia with one hand

while condemning its military actions with the other is clearly contradictory.

The Mistral deal and other arms shipments lay bare the difficulty of applying

pressure on Russia, even at a time when tensions between the West and Russia are

at their worst since the Cold War. European leaders have sought to protect

their defense industries even as they have sanctioned Russian officials over the

Crimea annexation. “We are executing the contract in full legal compliance

because we’ re not at that level of sanctions,” French President François

Hollande told reporters this month. If sanctions escalate, he said, France may

hold back on sending the ships.Monday, June 16, 2014

VATICAN CITY (Reuters) - Pope Francis sacked the five-man board of the Vatican's financial watchdog on Thursday - all Italians - in the latest move to break with an old guard associated with a murky past under his predecessor. The Vatican said the pope named four experts from Switzerland, Singapore, the United States and Italy to replace them on the board of the Financial Information Authority (AIF), the Holy See's internal regulatory office. The new board includes a woman for the first time. All five outgoing members were Italians who had been expected to serve five-year terms ending in 2016 and were laymen associated with the Vatican's discredited financial old guard. Reformers inside the Vatican had been pushing for the pope, who already has taken a series of steps to clean up Vatican finances, to appoint professionals with an international background to work with Rene Bruelhart, a Swiss lawyer who heads the AIF and who has been pushing for change. Vatican sources said Bruelhart, Liechtenstein's former top anti-money laundering expert, was chafing under the old board and wanted Francis to appoint global professionals like him.

VATICAN CITY (Reuters) - Pope Francis sacked the five-man board of the Vatican's financial watchdog on Thursday - all Italians - in the latest move to break with an old guard associated with a murky past under his predecessor. The Vatican said the pope named four experts from Switzerland, Singapore, the United States and Italy to replace them on the board of the Financial Information Authority (AIF), the Holy See's internal regulatory office. The new board includes a woman for the first time. All five outgoing members were Italians who had been expected to serve five-year terms ending in 2016 and were laymen associated with the Vatican's discredited financial old guard. Reformers inside the Vatican had been pushing for the pope, who already has taken a series of steps to clean up Vatican finances, to appoint professionals with an international background to work with Rene Bruelhart, a Swiss lawyer who heads the AIF and who has been pushing for change. Vatican sources said Bruelhart, Liechtenstein's former top anti-money laundering expert, was chafing under the old board and wanted Francis to appoint global professionals like him.

"Bruelhart wanted a board he could work with and it seems the pope has come down on his side and sent the old boy network packing," said a Vatican source familiar with the situation.

The new board of the AIF includes Marc Odendall, who administers and advises philanthropic organisations in Switzerland, and Juan C. Zarate, a Harvard law professor and senior advisor at the Center for Strategic and International Studies, a think tank based in Washington D.C. The other two board members are Joseph Yuvaraj Pillay, former managing director of the Monetary Authority of Singapore and senior advisor to that country's president, and Maria Bianca Farina, the head of two Italian insurance companies.

Francis, who was elected in March 2013 after the resignation of former Pope Benedict, in February set up a new Secretariat for the Economy reporting directly to him and appointed an outsider, Australian Cardinal George Pell, to head it.

In January he removed Cardinal Attilio Nicora, a prelate who played a senior role in Vatican finances for more than a decade, as president of the AIF and replaced him with an archbishop with a track record of reform within the Vatican bureaucracy.

He also replaced four of the five cardinals in the commission that supervises the Vatican's troubled bank, known as the Institute for Works of Religion (IOR).

Since the arrival of Bruelhart in 2012, the AIF has been spearheading reforms to bring the Vatican in line with international standards on financial transparency and money laundering. But Vatican sources say he has encountered resistance from an old, entrenched guard.

A report last December by Moneyval, a monitoring committee of the Council of Europe, said the Vatican had enacted significant reforms but must still exercise more oversight over its bank.

Francis, who has said Vatican finances must be transparent in order for the Church to have credibility, decided against closing the IOR on condition that reforms, including closing accounts by people not entitled to have them, continued.

Only Vatican employees, religious institutions, orders of priests and nuns and Catholic charities are allowed to have accounts at the bank. But investigators have found that a number were being used by outsiders or that legitimate account holders were handling money for third parties.

Monsignor Nunzio Scarano, a former senior Vatican accountant who had close ties to the IOR, is currently on trial accused of plotting to smuggle millions of dollars into Italy from Switzerland in a scheme to help rich friends avoid taxes.

Scarano has also been indicted on separate charges of laundering millions of euros through the IOR. Paolo Cipriani and Massimo Tulli, the IOR's director and deputy director, who resigned last July after Scarano's arrest, have been ordered to stand trial on charges of violating anti-money laundering norms.

Sunday, June 8, 2014

Over one million people in Spain - the eurozone's fourth largest economy - haven't had a job since 2010, according to a report by Spain's National Statistics Institute. Although this number continues to rise, the government says it's witnessing recovery.

Over one million people in Spain - the eurozone's fourth largest economy - haven't had a job since 2010, according to a report by Spain's National Statistics Institute. Although this number continues to rise, the government says it's witnessing recovery.

The numbers, published on May 23, show that “very long-term unemployment” in the country has risen by more than 500 percent since 2007. That year, about 250,000 Spaniards were unemployed after losing their job at least three years prior. That number drastically rose to 1.27 million in 2013 - 234,000 more than in 2012.

Generally, long-term unemployment includes jobless workers who have not been employed for more than 27 weeks. The recent study shows that this category in Spain has transformed to very long-term unemployment, with hundreds of thousands people without a job for at least three years, and is now represented by over 23 percent of the total jobless population in Spain.

The number is much higher than in other countries in the region at the same economic level, with another recent study showing that 26 percent of the country's population is on government benefits in Spain - the second highest total in the EU after Greece. Older jobless Spaniards are in a worse position than younger ones, who are more flexible and can emigrate and try to find work in other countries. But those with families and financial commitments are in danger of never finding work again. Edward Hugh, a British economist based in Spain, told the Spain Report that the situation is disastrous: "Many of these people are now 'structurally unemployed,' and many of those over 50 may never work again. It’s a national disaster,” he said.

Spain's new, smaller parties earned a relatively high number of votes in the recent EU elections. One of the newcomers, the Podemos (We Can) party, received almost eight percent of the votes, enough for five seats in the European Parliament. One of the political movement's MPs told The Spain Report that "a howl of protest against the unfairness, crushed dreams and hopeless futures caused by the existing economic system” is at the heart of the new party's support base.

Sunday, March 9, 2014

Businesses in the eurozone had their fastest growth for more than two and a half years, the Markit composite purchasing managers index showed. The growth was led by the region’s services sector, which expanded quicker than originally thought.

Businesses in the eurozone had their fastest growth for more than two and a half years, the Markit composite purchasing managers index showed. The growth was led by the region’s services sector, which expanded quicker than originally thought.

Here’s Reuters’ early story:Euro zone private businesses enjoyed their fastest growth rate in over 2-1/2 years last month as the region’s service industry expanded quicker than initially thought, surveys showed on Wednesday. The upturn in the 18-member bloc’s fortunes was again led by Germany, but the gulf between growth in Europe’s biggest economy and the decline in France has only been wider once in the 16-year history of the surveys. Markit’s final Eurozone Composite Purchasing Managers’ Index (PMI), which gauges business activity across thousands of companies and is seen as a good guide to economic health, was revised up to 53.3 from an initial flash reading of 52.7. That was the eighth month the index has been above the 50 mark that separates growth from contraction and beat January’s 52.9. The surveys suggest the region’s economy was on course to grow 0.4-0.5 percent in the first quarter, Markit said, more than the 0.3 percent growth predicted in a Reuters poll last month and would be the fastest expansion in three years. “The final PMI indicates that the euro zone economy grew at the fastest rate since June 2011, contrasting with the slowdown signalled by the flash reading,” said Chris Williamson, chief economist at survey compiler Markit. “However, regional divergences remain a concern,” he added. Germany’s composite PMI soared to a 33-month high but France’s fell further below the break-even mark where it has languished for most of the past two years. Italy and Spain, the third and fourth biggest economies in the bloc, both had robust growth.

Thursday, January 9, 2014

Capitalism covers a very wide range of systems, and is not the direct culprit for our problems. However, the way capitalism is implemented today is a big problem, it is undermining democracy and radicalizing large portions of the population. It will not end well, if this trend is allowed to persist.

Capitalism covers a very wide range of systems, and is not the direct culprit for our problems. However, the way capitalism is implemented today is a big problem, it is undermining democracy and radicalizing large portions of the population. It will not end well, if this trend is allowed to persist.

Probably the single most harmful detail is the stock exchange. There are many other issues also, but shareholders in particular have been given the rights of owners, which is illogical, as they are in fact speculators. The owners should be the long term caretakers of corporations, with managers more interested in short term benefits. All shareholders care about is the short to mid term value of the stock, not the long term viability of the enterprise. To get the managers to play this game, they have given managers salaries that approach investor profits in scale. As a result, capitalism has gone bananas, not caring for long term viability, the communities they function in, the environment, the law, not even the customers .... share value is all that counts these days and no cost is too great to achieve it.

Democratic Capitalism need not be like this, it is just the default mode of operation it will slip into if left unattended. And this mode is bent on self-destruction, with a tendency to degenerate into Fascism or Communism ... if left to play out its natural course. If this is not to happen, the democratic part of Democratic Capitalism needs to be more pronounced...point / counterpoint...Capitalism works because entrepreneurs and managers figure out how customers, employees, suppliers, communities, and people with the money all can cooperate to benefit....No it doesn't.

- Capitalism works by creating profit. Where there is profit there is deficit.

- Capitalism works by making profit out of the exploitation of those who create that profit in the first place. This is why workers are not paid the actual value of what they produce, because the capitalist or entrepreneur cant make any profit out of that.

- Capitalism may not be perfect, yet it is the greatest system of social co-operation ever created thus far.

No it isn't, the greatest system of social co-operation is where everyone is equal and treated equally, that is true co-operation. Capitalism is exploitation of the masses for the benefit of the minority.

Saturday, December 28, 2013

Russia's economy is now forecast to have grown in 2013 at less than half the pace expected at the start of the year and will perform only slightly better in 2014, weighed down by weak investment and tapering consumer demand.

Russia's economy is now forecast to have grown in 2013 at less than half the pace expected at the start of the year and will perform only slightly better in 2014, weighed down by weak investment and tapering consumer demand.

A Reuters poll of 15 economists said that gross domestic product had risen just 1.4 percent this year, when last December they had predicted an expansion of 3.2 percent.

Economists are also more pessimistic about the economy's well being next year than the government, envisaging growth of 2 percent, against the Economy Ministry's forecast of 2.5 percent.

Russia's economy decelerated sharply this year, reflecting deep structural problems that analysts and officials say undercut its long-term growth potential.

Investment by firms disappointed and international money has been flowing out of Russia, in part due to companies' concerns about political freedoms and the likely consistency of the legal backdrop in years ahead.

The fading of an economic success story that buoyed Vladimir Putin's first decade in power is increasingly a challenge to the president as he seeks reelection in 2018.

Economists now say there has been no growth in investment in tangible assets, such as buildings and plants, this year. A year ago, they had expected such expenditures would grow by 6 percent in 2013. For next year, they now expect a small rebound to 2 percent growth.

The pickup will come mainly from the expected spending from one of Russia's oil windfall revenue funds on infrastructure.

"However, their positive impact in 2014 should not be overestimated, as most likely it will not appear before the second half of the year," Maria Pomelnikova, an economist at Raiffeisenbank, said.

Friday, December 20, 2013

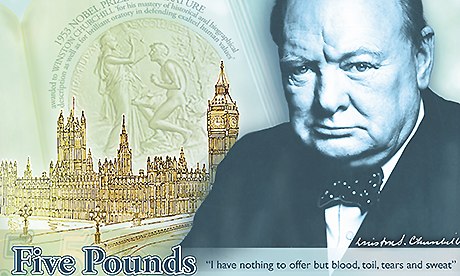

Concept design for new polymer £5 note featuring former British leader Winston Churchill. Photograph: AP

Mark Carney, the governor of the Bank of England, has formally announced that Britain will switch to using plastic banknotes in 2016, ending 320 years of paper money.

After a public consultation in which 87% of the 13,000 respondents backed the new-style currency, the Bank said it would introduce "polymer" notes, as it prefers to call them, in two years' time, starting with the new £5 note featuring Winston Churchill in 2016 and the Jane Austen £10 a year later.

Speaking at a press conference in the Bank's Threadneedle Street headquarters, Carney said: "Our polymer notes will combine the best of progress and tradition. They will be more secure from counterfeiting and more resistant to damage while celebrating the history and tradition that is important both to the Bank and the nation as a whole."

The move follows Carney's native Canada, where plastic notes are being rolled out, and Australia, where they have been in circulation for more than two decades.

Carney launched a public consultation on polymer banknotes, seen as cleaner and more durable, shortly after arriving at the Bank this summer. However, the Bank's notes division has been considering plastic money for several years.

Bank officials have been touring shopping centres and business groups around the country with prototype notes to canvas public opinion. The Bank has promoted its polymer notes, featuring a see-through window and other new security features, as less threadbare and tougher to counterfeit. It has sought to quell concerns about the environmental impact of printing on plastic by suggesting they can last up to two-and-a-half times longer than the cotton-paper notes in circulation at the moment. The durability will also compensate for the higher production costs and save an estimated £100m, the Bank claims. Its laboratory tests showed polymer banknotes only begin to shrink and melt at 120C, so they would fare better in washing machines but could be damaged by a hot iron.

Wednesday, December 11, 2013

Agreement among the WTO’s 159 member economies

Ministers meeting in Bali sealed agreement among the WTO’s 159 member economies for the pact, which eases barriers to trade by simplifying customs procedures, limiting agricultural subsidies, and promoting trade with least-developed nations.

Ministers meeting in Bali sealed agreement among the WTO’s 159 member economies for the pact, which eases barriers to trade by simplifying customs procedures, limiting agricultural subsidies, and promoting trade with least-developed nations.

The deal could boost global trade by $1 trillion and create 20 million new jobs, keeps alive the WTO’s broader 12-year marathon Doha Round of trade negotiations designed to reduce international tariff barriers, well ...I've just found out that governments from the United States to Australia and from Canada to the EU are secretly negotiating trade deals that will give global corporations the right to sue our governments and overturn our laws.

Details have leaked out on what is called the Trans Pacific Partnership (TPP) and the Transatlantic Trade & Investment Partnership (TTIP) that will massively expand the power of corporations to sue our governments.

Thousands of corporate lobbyists are helping to write these secret pacts -- but we're not allowed to see them. Governments know that we won't like these corporate power grabs, so they're hoping to keep them under the radar until it's too late to stop them. But if we can raise our voices now, we can expose these corporate charters and kill the deals forever.

Two secret new global pacts- the TTIP and TPP -could massively increase the power of corporations to sue our governments when they pass laws to protect our environment or our health. Unsurprised, its just four companies talking to each other - 8 largest U.S. financial companies (JP Morgan, Wells Fargo, Bank of America, Citigroup, Goldman Sachs, U.S. Bancorp, Bank of New York Mellon and Morgan Stanley) are 100% controlled by 10 shareholders and we have 4 companies always present i...n all decisions: BlackRock, State Street, Vanguard and Fidelity - who control the Federal Reserve. The same “big four” control the vast majority of European companies counted on the stock exchange. These same people run the IMF, the European Central Bank & the World Bank. The 10 largest US financial institutions hold 54% of US total financial assets. 90% of US media is owned by 6 corporations. We will tell you what the news is - the news is what we say it is - it turns out it is not illegal to falsify the news. 37 banks have merged to become just four since 1990. We are speaking of 6, 8 or maybe 12 families who truly dominate the world (perhaps Goldman Sachs, Rockefellers, Loebs Kuh and Lehmans in New York, the Rothschilds of Paris and London, the Warburgs of Hamburg, Paris and Lazards Israel Moses Seifs Rome). With Google accounting for over 65% of all web searches in the US and over 70% market share in most other countries, the top 10 owners of Google’s stock are Fidelity, BlackRock, State Street, Vanguard Group, Capital Research, T. Rowe Price, Capital World, Alliancebernstein, Marsico Capital. This is the world we live in.

Saturday, November 9, 2013

A major Swiss gold refiner is being

investigated on suspicion of money laundering linked to the processing of gold

allegedly looted from DR Congo. Swiss federal prosecutors confirmed criminal proceedings against

Argor-Heraeus SA, over claims it knew gold it handled in 2004 and 2005 had been

taken from DR Congo during an armed conflict. The case has been brought by the Swiss non-governmental organisation

TRIAL. Argor-Heraeus has strongly refuted

all allegations in a statement. The Swiss gold refiner said the allegation had "arrived like a bolt out of

the blue" and there had been "no request or contact whatsoever from TRIAL

beforehand".

A major Swiss gold refiner is being

investigated on suspicion of money laundering linked to the processing of gold

allegedly looted from DR Congo. Swiss federal prosecutors confirmed criminal proceedings against

Argor-Heraeus SA, over claims it knew gold it handled in 2004 and 2005 had been

taken from DR Congo during an armed conflict. The case has been brought by the Swiss non-governmental organisation

TRIAL. Argor-Heraeus has strongly refuted

all allegations in a statement. The Swiss gold refiner said the allegation had "arrived like a bolt out of

the blue" and there had been "no request or contact whatsoever from TRIAL

beforehand".

It said "Argor-Heraeus has been cleared of all above mentioned allegations",

referring to an investigation at the time by the UN, SECO and FINMA.

The firm said it would "collaborate in complete transparency with the

authorities" to prove its innocence.

'Growing

pressure'

The Swiss federal prosecutor's office said on Monday that after reviewing the

criminal complaint submitted by TRIAL, it had decided to initiate proceedings

against Argor-Heraeus "for suspected money laundering in connection with a war

crime and complicity in war crimes".

"Given the secrecy of the investigation and function, we are not able to

provide more information for now," it said.

TRIAL

alleges that gold looted from DR Congo in 2004 and 2005 was smuggled to

Uganda and then refined in Switzerland by Argor-Heraeus.

According to TRIAL, the refinery knew or should have assumed that the gold

resulted from pillage, a war crime.

DR Congo was in the midst of an armed conflict at the time, driven partly for

control of natural resources.

An estimated six million people are believed to have been killed in DR Congo

since 1997.

TRIAL says the sale of the gold "contributed to financing the operations of

an unlawful armed group in a brutal conflict".

A report at the time by a UN Group of Experts recommended sanctions against

Argor, saying the company must have known the gold was obtained illegally. Sanctions were imposed only on Ugandan businesses involved in the trade. TRIAL alleges that Argor escaped sanctions because of pressure applied at the

UN by Swiss diplomats.

However, Argor says that "subsequent detailed in-depth verifications executed

by SECO and UNO resulted in the removal of the name of Argor-Heraeus from the

report and confirmed that the company was in no way directly or indirectly

involved in the alleged claim".

Most of the world's gold is refined in Switzerland and the country is also a

major trading hub for gold and other commodities.

The BBC's Imogen Foulkes in Geneva says there is growing pressure for traders

and refiners to be more transparent.

Argor is owned partly by German company Heraeus, Commerzbank, and the

Austrian Mint.

Thursday, October 31, 2013

There is probably no way to know whether conflicts in the brokerage business are more severe or common than they used to be.

There is probably no way to know whether conflicts in the brokerage business are more severe or common than they used to be.

But they aren’t hard to find. An adviser might earn undisclosed fees that could taint his objectivity or recommend mutual funds run by his firm over cheaper third-party choices; he could collect upfront commissions on funds right before moving the client’s assets to a fee-based account.

Often, the code of conduct meant to guide brokers’ behavior doesn’t require them to act in their clients’ best interest. The Finra report urges firms to adopt such a proviso. Some firms don’t give brokers specialized training to sell complex products like “structured notes,” debt securities whose returns depend on factors beyond interest payments alone.

However, other firms review such products after launching them to see whether they perform as promised and to learn whether they have been sold to investors—or by brokers—who don’t understand them.

“That’s a strong process,” Ms. Axelrod says, “and one that I would strongly suggest that firms consider adopting.”

Some brokerages, according to the Finra report, refuse to offer higher payouts for selling in-house mutual funds or other investments; that might help prevent brokers from pushing funds that benefit the firm more than the client.

Friday, October 25, 2013

Huge storm do to hit England on monday

Forecasters warned on Thursday that the most powerful storm in several years would batter the south coast on Monday, but have now expanded the alert as far north as the east and West Midlands.

Winds are expected to reach up to 80mph in mainland areas, while in Cornwall and along the south coast they could at times be even stronger.

The Met Office have issued this prediction for the storm (MET OFFICE)

The Met Office have issued this prediction for the storm (MET OFFICE)

Forecasters have claimed the storm, which is still forming over the Atlantic, could be of similar strength to the great storm of 1987 and the Burns Day Storm in 1990. Met Office senior forecaster Helen Chivers warned that winds could get up to 90mph and said the storm could be exceptional: "This is not a storm you see every winter.

"The storm of 1987 is one, and the Burns day storm in January 1990 is another."

Some gusts are likely to top 12 on the Beaufort Scale, a level of force which is equivalent to a hurricane, but winds will not stay consistently at this speed as they would in a real tropical storm.

The "amber alert" issued by the Met Office says the weather system is expected to arrive in the early hours of Monday and last until up to 9pm, with heavy rain also expected in western and central areas.

Subscribe to:

Comments (Atom)