Showing posts with label ECB. Show all posts

Showing posts with label ECB. Show all posts

Tuesday, November 24, 2015

Thursday, June 18, 2015

Finland and Russia. Well

Finland is the only EU member nation to border Russia and not be a NATO member.

I suspect they are wary of Russia but have a greater understanding of Russia's

somewhat justified paranoia and anger with broken ' influence space' NATO

invasions since the 1990's. They seek the old USSR relationship probably which

worked well for Finland. Your last sentence captures this. BTW by many polls

the most pro-EU Nordic - not members yet (and they were in the list with

Denmark, UK and Ireland in the 1960's - is Norway. Following April's elections, Juha Sipila, the prime minister, Timo Soini, the

eurosceptic foreign minister and Alexander Stubb, the finance minister, have

pledged to create more jobs, to get the economy moving and avoid a "lost decade"

from a lack of reforms. Finland is out on its own compared to the other Nordic countries in joining

the Euro. Norway isn't even in the EU, Sweden has done well keeping the Krona

and Denmark has kept their Krona but ties it to the Euro, a tie that could

easily be broken if the proverbial hits the fan. Finland is looking rather

isolated. Of course the Baltic states are in the Euro but they have all paid a

heavy price for membership. Would I be right in thinking that Finland is being hurt by Russian

retaliatory sanctions rather more than other countries? Whilst they must have an

historical healthy fear of Russia, I would imagine they are far more scared

about the West restarting the Cold war in extreme earnest because of western

interference in the internal affairs of Ukraine.

Finland and Russia. Well

Finland is the only EU member nation to border Russia and not be a NATO member.

I suspect they are wary of Russia but have a greater understanding of Russia's

somewhat justified paranoia and anger with broken ' influence space' NATO

invasions since the 1990's. They seek the old USSR relationship probably which

worked well for Finland. Your last sentence captures this. BTW by many polls

the most pro-EU Nordic - not members yet (and they were in the list with

Denmark, UK and Ireland in the 1960's - is Norway. Following April's elections, Juha Sipila, the prime minister, Timo Soini, the

eurosceptic foreign minister and Alexander Stubb, the finance minister, have

pledged to create more jobs, to get the economy moving and avoid a "lost decade"

from a lack of reforms. Finland is out on its own compared to the other Nordic countries in joining

the Euro. Norway isn't even in the EU, Sweden has done well keeping the Krona

and Denmark has kept their Krona but ties it to the Euro, a tie that could

easily be broken if the proverbial hits the fan. Finland is looking rather

isolated. Of course the Baltic states are in the Euro but they have all paid a

heavy price for membership. Would I be right in thinking that Finland is being hurt by Russian

retaliatory sanctions rather more than other countries? Whilst they must have an

historical healthy fear of Russia, I would imagine they are far more scared

about the West restarting the Cold war in extreme earnest because of western

interference in the internal affairs of Ukraine.Monday, October 7, 2013

It changes by the hour ....what a circus !!! lies and deceit and that's all !!

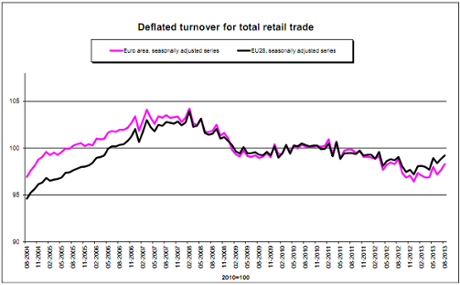

Eurostat reported that retail sales volumes rose by 0.7% in the euro area, and 0.4% across the wider European Union in August. July's data was also revised higher, showing consumers weren't as cautious about spending as first thought.

Eurostat's data shows that non-food shopping was strong, rising by 0.6% in the eurozone. That covers items such as computers, clothing and medical products.

The data also showed an increase in fuel purchases, suggesting a rise in motor journeys. Spending on "automotive fuel in specialized stores" (that's petrol stations to you and me) was up by 0.9% across euro members.

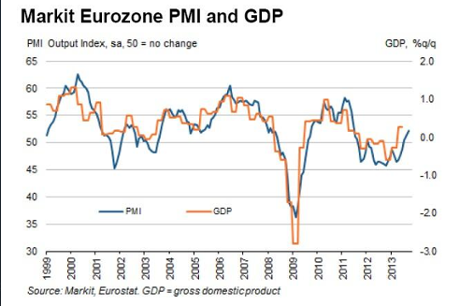

The eurozone recovery is gathering pace, with its private sector firms reporting the biggest leap in activity since June 2011 last month.

Data firm Markit's monthly surveys of companies across the single currency showed a solid rise in activity.

New business has picked up, and the rate of job cuts may finally be slowing to a halt.

Markit's monthly survey of activity came in at 52.2, up from August's 51.5. Both service sector firms and manufacturers said conditions were better.

Ireland: 55.7 2-month low

Germany: 53.2 2-month low

Italy: 52.8 29-month high

France: 50.5 20-month high

Spain: 49.6 2-month low

Germany: 53.2 2-month low

Italy: 52.8 29-month high

France: 50.5 20-month high

Spain: 49.6 2-month low

The news comes hours after China's service sector output hit a 6-month high.

Chris Williamson, chief economist at Markit, said the eurozone data showed Europe's recovery on track, despite Spain's private firms faltering after a better August.

Labels:

A.M.Press,

agenda de business,

creditare,

crisis,

currency,

eastern europe,

ECB,

economy,

EIB,

EUbusiness,

salvare euro,

stocks,

stupid,

UE,

ziare.com,

ziare.ro,

zona euro

Sunday, September 29, 2013

Friday, September 27, 2013

As long as we don't worship the Keynesian Dogma we are going to read things like this one.

Mr Rajoy said the eurozone's fourth largest economy was "out of

recession but not out of the crisis", and faced a long period of more austerity

before the country could sustain the recovery.

Mr Rajoy said the eurozone's fourth largest economy was "out of

recession but not out of the crisis", and faced a long period of more austerity

before the country could sustain the recovery.

"The task now is to achieve a vigorous recovery that allows us to create

jobs," he told the Wall Street

Journal.

Spain's unemployment rate, at 25pc, is among the highest in the eurozone. The

bloc's official unemployment rate of 12.1pc also masks huge disparities. While

Austria boasts an unemployment rate of just 4.8pc, the jobless rate in

bailed-out Greece is 27.6pc.

The recovery in Germany, Europe's largest economy, has also been fragile.

Data on Tuesday showed business sentiment rose for a fifth consecutive month in

September. The Ifo Institute's business climate index, which is based on a survey of

7,000 firms, rose to 107.7 in September, from 107.6 in August. However, the

reading fell short of the 108.2 expected by economists.

European Central Bank rate-setter Ewald Nowotny said on Tuesday that the bank

had "flexible" tools at its disposal if it needs to take additional measures,

including providing banks with additional central bank money. ECB President Mario Draghi said on Monday that the ECB stood ready to deliver

a fresh injection of cash into Europe's banks. Asked about the possibility of

the central bank giving banks another chance for those loans, known as Long Term

Refinancing Operations (LTRO), Mr Nowotny said: "It is certainly important to

show all that we have in the way of instruments, which are flexible...Pier Carlo Padoan, the OECD's chief economist, said he expected growth in the

17-nation bloc to be negative this year, despite several countries showing signs

of recovery. Mr Padoan said the single currency area, which emerged from its longest

recession in more than 40 years in the second quarter, remained "a considerable

source of risk" to the global recovery, though he added that the systemic risk

from the eurozone's debt crisis had subsided. He added that while countries should continue to implement austerity

policies, automatic stabilisers such as unemployment benefits should be allowed

to kick-in if economies stalled. Mr Padoan also urged policymakers to tackle

high jobless rates. "There is no doubt that policy priority number one in the euro area is

fighting unemployment. Let's not fool ourselves and expect unemployment to come

down in a stable fashion," he said.

Economists expect growth in the eurozone to pick up in the second half of the

year. On Monday, Spanish prime minister Mariano Rajoy said the country would

exit recession - defined as two or more consecutive quarters of negative output

- in the third quarter, following two years of contraction.

Labels:

A.M.Press,

agenda de business,

criza datoriilor de stat,

currency,

curs,

Draghi,

ECB,

economia,

economy,

European Central Bank,

reuters,

revista presei,

UE,

ziare.com,

ziare.ro

Tuesday, July 16, 2013

€-exposure...

Much more dangerous is the €-exposure that France, answering the exposure

question in France that the ECB demanded, reduced it, and kept investor

confidence, by transferring exposure to French banks outside France whilst

strictly speaking answering the ECB honestly.

Much more dangerous is the €-exposure that France, answering the exposure

question in France that the ECB demanded, reduced it, and kept investor

confidence, by transferring exposure to French banks outside France whilst

strictly speaking answering the ECB honestly.SocGen - St. Pierre et Miquelon and Débit Agricole Genève are 2 examples... In any case the big European lenders felt unease with the initial Bernake’s comments about restrictive monetary policy. The European financial system is currently oiled well with plenty of American dollars. If they are to be withdrawn there has to be a replacement. So Eurozone’s lenders asked and the ECB quickly responded with a completely new policy principle, the main characteristic of which will be plenty and zero cost euros for the ‘guys’.----- This decision was taken unanimously in ECB’s Governing Council last week with Germany not hesitating this time to support such a generous policy.----- The key to this Teutonic alignment with the rest of Eurozone member states is that the German banks are the first to need this ECB money bonanza. Many lenders in this country are dangerously undercapitalized and need badly this zero cost liquidity from the ECB. All in all, either way western banks are now reassured that nothing will be done without their consent. The American Fed will continue to replenish their coffers with $85bn a month, and if the time comes for a change in the American generosity to banks, ---- the ECB is ready to take over.--"

DOWN SOUTH AS THEY SAY ...

There is a cultural problem in Portugal that makes this crisis worse. It has

nothing to do with "laziness", "sunbathing culture" or other silly stereotypes

often posted in these forum. The problem is a deep immersion in what I would

call a "leftist cultural mindset" in a broad sense. Most people are not exactly

communist, but they don't think good on entrepreneurs, they do not trust

capitalists. In a conflict between a landlord and the home occupier they take

position against the former, as if to be a landlord was a sinister capitalist

exploitation. This makes any reforms towards a more market-driven economy much more

difficult, specially so because even Constitutional Court justices fall into

this leftist mindset. Most people misunderstand this austerity measures. They blame the government,

they blame the troika, they blame sometimes the Germans, and so on, as if this

austerity was not necessary, as if it was a mischievous act. It's a silly thing,

but unfortunately most Portuguese, not only low class, but even the middle

class, feel a deep sense of entitlement and for them a wage cut or worse a job

dismissal, is morally akin to a evil act. This explains the political manifestations against the troika and against

austerity. Because of ignorance, people feels this austerity is an evil act

designed to increase capitalist exploitation, and to line the pockets of the

rich (how silly!). Then, their protest is self-righteous. Mind you, they are

NOT exactly just defending selfishly their interests. They are more idealistic

than that. They feel they occupy a moral highground and that the architects of

austerity are wrong or even evil. Unfortunately, some writings by Ambrose suggest that he blames austerity

almost as intensely, thus joining forces with the ignorant Greek and Portuguese

masses, which criticize austerity without understanding the gravity of this

situation.

Wednesday, May 15, 2013

The European Union - in the longest recession ever

The eurozone has slumped into its longest recession ever, after economic activity across the region fell for the sixth quarter in a row. Economic output across the single currency area fell by 0.2% in the first three months of 2013, statistics body Eurostat reported on Wednesday. France, Spain, Italy and the Netherlands all saw their economies shrink as the economic crisis in the eurozone continued to hit its largest economies. Eurostat's figures showed that the eurozone economy has contracted by 1% over the last year, putting further pressure on leaders as unemployment climbs to new record highs. The 0.2% contraction in the first quarter was an improvement on the 0.6% drop recorded between October and December, but analysts warned that the eurozone's economic outlook is darkening. "What seems incontrovertible, on this evidence, is that the member-states of the euro zone are on the wrong track," commented Stephen Lewis, chief economist at Monument Securities. "The costs of the zone's one-size-fits-all strategy are becoming brutally apparent."

The eurozone has slumped into its longest recession ever, after economic activity across the region fell for the sixth quarter in a row. Economic output across the single currency area fell by 0.2% in the first three months of 2013, statistics body Eurostat reported on Wednesday. France, Spain, Italy and the Netherlands all saw their economies shrink as the economic crisis in the eurozone continued to hit its largest economies. Eurostat's figures showed that the eurozone economy has contracted by 1% over the last year, putting further pressure on leaders as unemployment climbs to new record highs. The 0.2% contraction in the first quarter was an improvement on the 0.6% drop recorded between October and December, but analysts warned that the eurozone's economic outlook is darkening. "What seems incontrovertible, on this evidence, is that the member-states of the euro zone are on the wrong track," commented Stephen Lewis, chief economist at Monument Securities. "The costs of the zone's one-size-fits-all strategy are becoming brutally apparent."

France was dragged back into recession by a 0.2% drop in GDP, announced on the first anniversary of François Hollande being sworn in as president. Pierre Moscovici, French finance minister, denied Paris's forecast of 0.1% growth this year was too optimistic. "I'm sticking to the figures," Moscovici told reporters, adding that the EU must prioritise growth over tackling budget deficits.

There was also disappointment that Germany eked out growth of just 0.1%, worse than economists had expected. The Dutch economy shrank by 0.1%. "The bottom line is that both the German and French economies, which together account for half of the eurozone's output, are in the doldrums," said Nick Spiro of Spiro Sovereign Strategy. "Add in the persistent recession in the Netherlands, which accounts for a further 6.5% of eurozone GDP, and the core and semi-core of the eurozone are in significantly worse shape than a year ago."

Italy's new prime minister, Enrico Letta, was given an early reminder of the challenge he faces with the news that Italian GDP fell by 0.5%. Italy's economy has been shrinking for the last seven quarters, its longest recession since at least 1970.

Beyond the eurozone, the Czech Republic suffered a 0.8% decline in GDP during the quarter. The data came a day after the Washington-based Pew Research Centre reported that public support for the European Union had fallen over the last year, from 60% to 45%. Pew warned that the ongoing financial crisis means the European project was "in disrepute" in some countries, with many Europeans losing faith in closer integration. "These results spell trouble ahead for the EU," said Lewis."They are likely to be taken seriously in Washington."

Eurostat's figures also showed that the European Union shrank by 0.1% during the last quarter, despite the UK growing by 0.3%.

Figures released last week showed that Spain's economy contracted by 0.5%.

Monday, April 1, 2013

"It defies belief that Poland and others are still keen on joining the

economic doomsday machine of the single currency"

No.....What defies belief is not that they may wish to join,but that they may

still be allowed to do so. The EU if it contains any semblance of self awareness

should by now have come to understand that it has a problem in trying to operate

a single currency in the way it does. That problem being manifest by the

broadening economic malaise in Europe and the growing political risk arising

from it.

No.....What defies belief is not that they may wish to join,but that they may

still be allowed to do so. The EU if it contains any semblance of self awareness

should by now have come to understand that it has a problem in trying to operate

a single currency in the way it does. That problem being manifest by the

broadening economic malaise in Europe and the growing political risk arising

from it. One might think therefore that the EU might at this juncture wish to pause and rectify the problem it has before it spreads it net and brings into the fold new 'meat' that will simply feed the problem for the future.

One of the main things that makes the human race superior to other species in

it's ability to survive is we learn through iteration. When we do something

wrong we figure out what it was and adapt doing something differently next time

so that we do not simply perpetuate all of our previous mistakes. The EU in

considering expansion without first learning from it's current litany of

mistakes and problems promises to continue to do the same thing expecting a

different outcome. Begs the question then if it cannot learn from it's mistakes

is it even 'human'? !

Certainly when I consider the behaviour of individuals like Wolfgang

Schaeuble I find myself thinking of the cult film "Terminator". What did you say

Wolfgang? "I'll be back".

Yes,that's what we are all afraid of.

NOW, about Cyprus ...Cyprus has been destroyed by the EURO, the TROIKA and its own Cypriot politicians....Europe is a mess because of the liberal elitist puke scum that want to destroy SOVEREIGNTY / CULTURE / RELIGION...Even the Archbishop see this....Cyprus, like all the European Countries , needs leaders that love their country.

It is a sign of the times when I find myself agreeing with the Archbishop and must acknowledge he is the only Cypriot offering leadership. Today he put the Church's resources at the disposal of the Cypriot people. His exact words were 'no one will starve'. A 'Christian' acting like a christian for once instead of chanting meaningless words and dogma.

NOW, about Cyprus ...Cyprus has been destroyed by the EURO, the TROIKA and its own Cypriot politicians....Europe is a mess because of the liberal elitist puke scum that want to destroy SOVEREIGNTY / CULTURE / RELIGION...Even the Archbishop see this....Cyprus, like all the European Countries , needs leaders that love their country.

It is a sign of the times when I find myself agreeing with the Archbishop and must acknowledge he is the only Cypriot offering leadership. Today he put the Church's resources at the disposal of the Cypriot people. His exact words were 'no one will starve'. A 'Christian' acting like a christian for once instead of chanting meaningless words and dogma.

Monday, January 7, 2013

Growth in China, Risks in the USA...If the situation in Southern Europe doesn't improve in 2013, the German economy will become even more dependent on consumers in the rest of the world -- particularly in the United States and China.

Growth in China, Risks in the USA...If the situation in Southern Europe doesn't improve in 2013, the German economy will become even more dependent on consumers in the rest of the world -- particularly in the United States and China.

Concerns about a slump in Chinese growth have eased recently, with the World Bank revising its growth forecast upwards. And demand from emerging economies continues to be good.

But the situation in the US is more difficult. President Barack Obama's re-election has dispelled some uncertainty, but the country's political divide is deeper than ever before. The brinkmanship that saw a deal reached on Jan. 1 on the "fiscal cliff" may have averted disaster, but it hardly inspires confidence in the world's largest economy. And while there may have been a last-minute deal, it is difficult to predict what effect it will have. After the Democrats and Republicans reached an 11th-hour deal on the budget in 2011, rating agency Standard & Poor's responded to the deal by stripping the US of its highest rating.

The shakier the global economy, the more important domestic demand becomes. In Germany, companies have been wavering for some time, with investment in new equipment declining over the past year. Consumers, on the other hand, have been a driver of the German economy, a first in a country that has often been criticized for its heavily export-dependent economy.

"Even during the financial crisis, consumption was solid as a rock," said Ifo's Carstensen. "That was because the labor market was supported by measures such as shorter working hours."

However, at the end of 2012, that mood deteriorated, with the GfK consumer confidence index falling twice in a row, largely because of fears over employment prospects. According to a survey by insurer Allianz, the fear of job losses has increased significantly over the past year. Thus far, many German companies had continued to hire new staff, while existing workers benefited from salary increases secured through collective bargaining agreements. According to Weber, however, "that positive trend in the labor market is broken."

During the 2009 financial crisis, after the federal government introduced its short-time working program, many German companies sucessfully avoided layoffs. And Weber believes 2013 will not see any catastrophic plunge. "There will be no major downturn," he says, but rather "more of a long, drawn-out dampening."

Sunday, January 6, 2013

Both the general collapse brought on by the 2009 economic crisis and Germany's record-breaking recovery caught people here by surprise. The consensus among economists for 2013 is that Germany will face steep challenges -- though fewer than those expected in many other countries.

Both the general collapse brought on by the 2009 economic crisis and Germany's record-breaking recovery caught people here by surprise. The consensus among economists for 2013 is that Germany will face steep challenges -- though fewer than those expected in many other countries.

Most economists have already revised downwards their forecast for this year and are even presuming a contraction in economic growth for the final quarter of 2012. The prediction now is for a slight growth in performance in 2013 and -- most importantly -- that the country will avert a recession.

It's an outlook cautiously shared by most German business leaders. According to the Munich-based Institute for Economic Research (Ifo), the current business climate index is poor, but expectations for the next six months have improved significantly.

That sentiment is not rock solid, however. "We measure the uncertainty by determining how wide the variations between companies are in assessing the current situation," warns Ifo chief economist Kai Carstensen. "And that differential has recently increased considerably."

Such uncertainty may seem odd, since the situation is noticeably calmer than at the outset of the financial crisis. The collapse of the United States real estate market in 2008 sent tremors through the global economy, severely affecting German companies.

Yet that drama had the silver lining -- at least from a business perspective -- of having a clear cause and effect. Now, economic growth is dependent on several, much more amorphous factors, such as:

- The euro crisis

- The US and Chinese economies

- Domestic consumption and investment in Germany

The euro crisis is particularly complex and confusing, and thus threatening, to companies. A recent survey of chief executives conducted by the German news agency DPA found that, unanimously, their biggest wish for 2013 was an end to the crisis.

Thursday, December 13, 2012

Winning the war against the people of Europe ...

Europe (Germany in fact) clinched a deal on Thursday to give the European Central Bank new powers

to supervise euro zone banks from 2014, embarking on the first step in a new

phase of closer integration to help underpin the euro. After more than 14 hours

of talks and following months of tortuous negotiations, finance ministers from

the European Union’s 27 countries agreed to hand the ECB the authority to

directly police at least 150 of the euro zone’s biggest banks and intervene in

smaller banks at the first sign of trouble. “This is a big first step for

banking union,” EU Commissioner Michel Barnier told a news conference. “The ECB

will play the pivotal role, there’s no ambiguity about that.” The euro rose to

a session high in Tokyo of 1.3080 against the U.S. dollar on news of the deal.

After three years of piecemeal crisis-fighting measures, agreeing on a banking

union lays a cornerstone of wider economic union and marks the first concerted

attempt to integrate the bloc’s response to problem banks. The new system of

supervision should be up and running by March 1, 2014, following talks with the

European Parliament, although ministers agreed that could be delayed if the ECB

needed longer to prepare itself. The plan sets in motion one of the biggest

overhauls of any European banking system since the financial crisis began in

mid-2007 with the near collapse of German lender IKB. The focus is now on EU

leaders, who meet in Brussels on Thursday and Friday, to give it their full

political backing. In an about-turn, German Finance Minister Wolfgang Schaeuble

dropped earlier objections that had led him to clash openly with his French

counterpart, Pierre Moscovici, last week over the ECB’s role in banking

supervision. With time running out to meet a year-end deadline, both sides

managed to settle their differences and Germany won concessions to temper the

authority of the ECB’s Governing Council over the new supervisor. Agreement on

bank surveillance is a crucial first step towards a broader banking union, or

common euro zone approach to dealing with failing banks that in recent years

dragged down countries such as Ireland and Spain. The next pillar of a banking

union would be the creation of a central system to close troubled banks. The

decision also sends a strong signal to investors that the euro zone’s 17

members, from powerful Germany to stricken Greece, can pull together to tackle

the bloc’s problems.

Europe (Germany in fact) clinched a deal on Thursday to give the European Central Bank new powers

to supervise euro zone banks from 2014, embarking on the first step in a new

phase of closer integration to help underpin the euro. After more than 14 hours

of talks and following months of tortuous negotiations, finance ministers from

the European Union’s 27 countries agreed to hand the ECB the authority to

directly police at least 150 of the euro zone’s biggest banks and intervene in

smaller banks at the first sign of trouble. “This is a big first step for

banking union,” EU Commissioner Michel Barnier told a news conference. “The ECB

will play the pivotal role, there’s no ambiguity about that.” The euro rose to

a session high in Tokyo of 1.3080 against the U.S. dollar on news of the deal.

After three years of piecemeal crisis-fighting measures, agreeing on a banking

union lays a cornerstone of wider economic union and marks the first concerted

attempt to integrate the bloc’s response to problem banks. The new system of

supervision should be up and running by March 1, 2014, following talks with the

European Parliament, although ministers agreed that could be delayed if the ECB

needed longer to prepare itself. The plan sets in motion one of the biggest

overhauls of any European banking system since the financial crisis began in

mid-2007 with the near collapse of German lender IKB. The focus is now on EU

leaders, who meet in Brussels on Thursday and Friday, to give it their full

political backing. In an about-turn, German Finance Minister Wolfgang Schaeuble

dropped earlier objections that had led him to clash openly with his French

counterpart, Pierre Moscovici, last week over the ECB’s role in banking

supervision. With time running out to meet a year-end deadline, both sides

managed to settle their differences and Germany won concessions to temper the

authority of the ECB’s Governing Council over the new supervisor. Agreement on

bank surveillance is a crucial first step towards a broader banking union, or

common euro zone approach to dealing with failing banks that in recent years

dragged down countries such as Ireland and Spain. The next pillar of a banking

union would be the creation of a central system to close troubled banks. The

decision also sends a strong signal to investors that the euro zone’s 17

members, from powerful Germany to stricken Greece, can pull together to tackle

the bloc’s problems.Monday, November 12, 2012

Heil ....

Finance minister Wolfgang Schaeuble (pictured, below) has

asked its panel of economic advisers, known as the "wise men", to look into

France's reform proposals, amid concerns that weaknesses could spread to

Germany and the rest of Europe, according to Reuters.

More from the newswire: Schaeuble's request denotes growing concern in Berlin and

among private economists over the health of the French economy, which is set to

miss a European Union goal for reducing its public deficit next year.

"Concerns are growing given the lack of action of the French government in

labour market reforms," Lars Feld, an economist who sits on the panel, told

Reuters.

Although Schaeuble raised the prospect of a report on France with members

of the council this week, Feld and the finance ministry made clear that the

government had not submitted a formal request. The ministry declined comment on

the minister's "unofficial discussions" in general.

Sunday, May 20, 2012

World leaders meeting at the weekend’s G8 summit in the US are to focus heavily

on the European crisis Saturday, after President Barack Obama aligned himself

with the new French president’s drive for more economic stimulus.

...AFP - Leaders of the world's most powerful nations were to

focus their attention on Europe's economic woes Saturday after President Barack

Obama threw his weight behind French calls for more pro-growth policies. Obama

set the stage for a fractious G8 summit here by forging an alliance with new

French President Francois Hollande over the need to jolt Europe back to growth.

Fearing Europe's economic crisis is poised to worsen -- with dangerous

repercussions for the US economy and perhaps his chances of re-election -- Obama

weighed in, risking the ire of German Chancellor Angela Merkel who has

championed an austerity-first approach. Shortly before welcoming Merkel and

other leaders to the famed presidential retreat outside Washington, Obama noted

Friday that events in Europe held "extraordinary" importance for the United

States. The G8 needs to discuss "a responsible approach to fiscal consolidation

that is coupled with a strong growth agenda," he said. To kick-off the summit a

tie-free Obama greeted leaders shortly after dusk Friday at the threshold of his

wood cabin for an informal dinner that lasted more than two hours. But the

dressed-down atmosphere did little to relieve tensions, which have been stoked

by the belief that two years of painful cuts demanded by Germany and others have

undercut Greek growth and made recovery more difficult. In what may have been a

telling moment, Obama greeted Merkel at his Laurel Lodge with a cordial: "How've

you been?" When her response came: a shrug and pursed lips, Obama conceded:

"Well, you have a few things on your mind." Publicly European leaders have

attempted to smooth over the splits within the G8, insisting austerity and

stimulus need not be mutually exclusive. "We need to take action for growth

while staying the course in terms of putting our public finances in order.

Stability and growth go together, they are two sides of the same coin," European

Commission chief Jose Manuel Barroso said ahead of the summit. But with Greece's

fiscal crisis apparently approaching denouement, those good words may be sorely

tested....

World leaders meeting at the weekend’s G8 summit in the US are to focus heavily

on the European crisis Saturday, after President Barack Obama aligned himself

with the new French president’s drive for more economic stimulus.

...AFP - Leaders of the world's most powerful nations were to

focus their attention on Europe's economic woes Saturday after President Barack

Obama threw his weight behind French calls for more pro-growth policies. Obama

set the stage for a fractious G8 summit here by forging an alliance with new

French President Francois Hollande over the need to jolt Europe back to growth.

Fearing Europe's economic crisis is poised to worsen -- with dangerous

repercussions for the US economy and perhaps his chances of re-election -- Obama

weighed in, risking the ire of German Chancellor Angela Merkel who has

championed an austerity-first approach. Shortly before welcoming Merkel and

other leaders to the famed presidential retreat outside Washington, Obama noted

Friday that events in Europe held "extraordinary" importance for the United

States. The G8 needs to discuss "a responsible approach to fiscal consolidation

that is coupled with a strong growth agenda," he said. To kick-off the summit a

tie-free Obama greeted leaders shortly after dusk Friday at the threshold of his

wood cabin for an informal dinner that lasted more than two hours. But the

dressed-down atmosphere did little to relieve tensions, which have been stoked

by the belief that two years of painful cuts demanded by Germany and others have

undercut Greek growth and made recovery more difficult. In what may have been a

telling moment, Obama greeted Merkel at his Laurel Lodge with a cordial: "How've

you been?" When her response came: a shrug and pursed lips, Obama conceded:

"Well, you have a few things on your mind." Publicly European leaders have

attempted to smooth over the splits within the G8, insisting austerity and

stimulus need not be mutually exclusive. "We need to take action for growth

while staying the course in terms of putting our public finances in order.

Stability and growth go together, they are two sides of the same coin," European

Commission chief Jose Manuel Barroso said ahead of the summit. But with Greece's

fiscal crisis apparently approaching denouement, those good words may be sorely

tested....The euro zone crisis is set to dominate four days of intense diplomacy which began in Washington Friday morning and continued through a meeting of G8 leaders at the presidential retreat Camp David on Friday evening. Discussions will continue there on Saturday and on to a Nato meeting in Chicago.

In talks at the White House, only hours before the Camp David summit, Obama met the new French president, François Hollande, for a one-to-one conversation in which he explored the possibility of a new approach to the eurozone crisis based on a pro-growth, stimulus strategy. Obama has been pressing for such a strategy for the past three years and has a potential ally in Hollande.

The White House welcomed what it sees as a change in the debate since Hollande's election that tilts the balance slightly more in favour of a growth strategy. The French president is proposing an EU-wide financial transaction tax (FTT) that could raise up to €57bn a year that could be used to stimulate the 27-nation bloc. After meeting Obama, Hollande was scheduled to meet David Cameron in Washington before flying to Camp David.

However on arriving in the US, Cameron said: "On the financial transactions tax I'm very clear. We are not going to get growth in Europe or Britain by introducing a new tax that would actually hit people as well as financial institutions. I don't think it is a sensible measure. I will not support it."

Friday, May 18, 2012

We are constantly told that if we don't all neoliberalize everything, screw

the poor to give to the rich and destroy all civilized parts of our society then

the clever wizards say that TERRIBLE THINGS will happen. The "markets" and the

"euro" and other abstractions will PUNISH US. No mechanisms are ever explained.

Funny how much this resembles the wizards and magical shamans of the middle ages

saying that God is on their side. If we don't give our tithes to the church then

God will punish us, little children. ... One estimate put the cost to the

eurozone of Greece making a disorderly exit from the currency at $1tn, 5% of

output. This is exactly the kind of economic prediction that I'm talking

about. How on Earth can they predict this with any degree of remote accuracy?

It's like trying to predict the exact results of every match at the upcoming

European Championships. Still, you can be virtually certain about one thing in

both the football and the economy. Greece will eventually get knocked

out. ---- THE FACTS ARE :...If Greece decides to leave the euro it'll certainly make

sense in the longer term-- the macroeconomic conditionality attached to the euro

by the ECB is a 'one size fits all' framework designed to promote the economies

of the EU's richer countries, and Greece is never going to derive any benefit

from being in the euro. But for now economic catastrophe looms since Greece's

current debt is denominated in euros, and the new drachma will involve a swift

and drastic devaluation. There is no way Greece can pay its euro debt using the

new drachma. The humane solution would be for the richer nations to cancel

Greece's debt the moment it leaves the euro. To not do so would be to punish

millions of ordinary people who did nothing to cause this crisis.

We are constantly told that if we don't all neoliberalize everything, screw

the poor to give to the rich and destroy all civilized parts of our society then

the clever wizards say that TERRIBLE THINGS will happen. The "markets" and the

"euro" and other abstractions will PUNISH US. No mechanisms are ever explained.

Funny how much this resembles the wizards and magical shamans of the middle ages

saying that God is on their side. If we don't give our tithes to the church then

God will punish us, little children. ... One estimate put the cost to the

eurozone of Greece making a disorderly exit from the currency at $1tn, 5% of

output. This is exactly the kind of economic prediction that I'm talking

about. How on Earth can they predict this with any degree of remote accuracy?

It's like trying to predict the exact results of every match at the upcoming

European Championships. Still, you can be virtually certain about one thing in

both the football and the economy. Greece will eventually get knocked

out. ---- THE FACTS ARE :...If Greece decides to leave the euro it'll certainly make

sense in the longer term-- the macroeconomic conditionality attached to the euro

by the ECB is a 'one size fits all' framework designed to promote the economies

of the EU's richer countries, and Greece is never going to derive any benefit

from being in the euro. But for now economic catastrophe looms since Greece's

current debt is denominated in euros, and the new drachma will involve a swift

and drastic devaluation. There is no way Greece can pay its euro debt using the

new drachma. The humane solution would be for the richer nations to cancel

Greece's debt the moment it leaves the euro. To not do so would be to punish

millions of ordinary people who did nothing to cause this crisis.

Outgoing PM Lucas Papademos has warned it would be "disastrous"

for Greece to reject the austerity measures, which come as a condition of its

bailout cash: Any modification... must be pursued in a spirit of consensus

and with the full agreement of European peers. A unilateral rejection of the

country's contractual obligations would be disastrous for Greece, leading

unavoidably outside the euro and possible outside the European

Union....The decisions we take could seal Greece's course for decades.

They could lead the country to the fringe, canceling historic national

achievements of the last 38 years.

Tuesday, February 8, 2011

The Romanian National Bank has a forex reserve nearly double as high as Romania's short-term external debt, and can be considered excessive when compared with that of other central banks in the region, after having received nearly 10 billion euros from the International Monetary Fund (IMF) in the past two years via an arrangement concluded precisely out of fear that the reserve may not be high enough to cover the debt in case of an external shock. The reserve became so big that, all of a sudden, the NBR decided it no longer wanted money from the IMF, so Romania will not draw the last 1 billion-euro instalment of the loan. In other words, the loan taken out proved to be bigger than needed, especially since 3.5 billion euros went straight into the budget instead of going into the NBR's reserve. But it is still the NBR who will have to pay back the money taken out from the IMF.

"As far as forex reserves are concerned, things have been good for some time. The reserves have been kept at this level in order to calm the financial markets, which had become too jittery," comments financial analyst Aurelian Dochia. He believes aside from the high level of forex reserves, the last instalment of the IMF loan was no longer important also because economic forecasts point to an economic improvement in 2011.

The NBR reserves amounted to around 35.9 billion euros at the end of January, which includes the 3.2 billion-euro value of the 103.7 tonnes of gold.

"As far as forex reserves are concerned, things have been good for some time. The reserves have been kept at this level in order to calm the financial markets, which had become too jittery," comments financial analyst Aurelian Dochia. He believes aside from the high level of forex reserves, the last instalment of the IMF loan was no longer important also because economic forecasts point to an economic improvement in 2011.

The NBR reserves amounted to around 35.9 billion euros at the end of January, which includes the 3.2 billion-euro value of the 103.7 tonnes of gold.

Subscribe to:

Comments (Atom)