A bizarre interview that Bannon gave to the liberal magazine the American Prospect – in which he claimed there was no military solution for North Korea, called the far right a “collection of clowns”, and said the left’s focus on racism would allow him to “crush the Democrats” – may have altered the balance of the power inside the West Wing. For an aide long suspected of leaking freely about rivals, Bannon’s excuse that he thought the call was off the record was not helpful. Bannon’s departure leaves a major void in the White House, depriving it of a man once seen as Cardinal Richelieu in cargo pants, an unkempt schemer adept at manipulating the president, who was famously depicted as a childlike naif to his aide’s Grim Reaper in a Saturday Night Live sketch. The characterization – summed up in a Time magazine cover that hailed “the great manipulator” – reportedly annoyed the famously thin-skinned president and contributed to his fall from grace. Josh Green, the author of the book Devil’s Bargain about Bannon and Trump, told the Guardian: “Bannon may be the only person in the White House with clear and distinct politics of his own.” His absence means more power and influence for figures such as Trump’s son-in-law Jared Kushner and the national economic council chair, Gary Cohn, who have few, if any, ideological ties to the Republican party and the conservative movement. Bannon has long occupied an unusual position in the White House. In an administration that one outside ally compared to Baskin Robbins, “composed of 31 flavors,” Bannon represented “the nationalist Trump coalition” as opposed to “a lot of people that were not only not Trump supporters but anti-Trump people”. One Bannon ally told the Guardian that the West Wing had seen a “four-on-one fight” recently, with Bannon taking on a coalition of Kushner, Ivanka Trump, Cohn and national security adviser HR McMaster. In the ally’s eyes Bannon represented the populist “burn it all down” path while others in the administration wanted Trump to “move the center” and work with the establishment. A White House source claimed to Axios: “His departure may seem turbulent in the media, but inside it will be very smooth. He has no projects or responsibilities to hand off.” Bannon had also stood out as the lone White House staffer to defend Trump’s comments on Charlottesville in recent days.

A bizarre interview that Bannon gave to the liberal magazine the American Prospect – in which he claimed there was no military solution for North Korea, called the far right a “collection of clowns”, and said the left’s focus on racism would allow him to “crush the Democrats” – may have altered the balance of the power inside the West Wing. For an aide long suspected of leaking freely about rivals, Bannon’s excuse that he thought the call was off the record was not helpful. Bannon’s departure leaves a major void in the White House, depriving it of a man once seen as Cardinal Richelieu in cargo pants, an unkempt schemer adept at manipulating the president, who was famously depicted as a childlike naif to his aide’s Grim Reaper in a Saturday Night Live sketch. The characterization – summed up in a Time magazine cover that hailed “the great manipulator” – reportedly annoyed the famously thin-skinned president and contributed to his fall from grace. Josh Green, the author of the book Devil’s Bargain about Bannon and Trump, told the Guardian: “Bannon may be the only person in the White House with clear and distinct politics of his own.” His absence means more power and influence for figures such as Trump’s son-in-law Jared Kushner and the national economic council chair, Gary Cohn, who have few, if any, ideological ties to the Republican party and the conservative movement. Bannon has long occupied an unusual position in the White House. In an administration that one outside ally compared to Baskin Robbins, “composed of 31 flavors,” Bannon represented “the nationalist Trump coalition” as opposed to “a lot of people that were not only not Trump supporters but anti-Trump people”. One Bannon ally told the Guardian that the West Wing had seen a “four-on-one fight” recently, with Bannon taking on a coalition of Kushner, Ivanka Trump, Cohn and national security adviser HR McMaster. In the ally’s eyes Bannon represented the populist “burn it all down” path while others in the administration wanted Trump to “move the center” and work with the establishment. A White House source claimed to Axios: “His departure may seem turbulent in the media, but inside it will be very smooth. He has no projects or responsibilities to hand off.” Bannon had also stood out as the lone White House staffer to defend Trump’s comments on Charlottesville in recent days.

Showing posts with label Basa Press. Show all posts

Showing posts with label Basa Press. Show all posts

Saturday, August 19, 2017

A bizarre interview that Bannon gave to the liberal magazine the American Prospect – in which he claimed there was no military solution for North Korea, called the far right a “collection of clowns”, and said the left’s focus on racism would allow him to “crush the Democrats” – may have altered the balance of the power inside the West Wing. For an aide long suspected of leaking freely about rivals, Bannon’s excuse that he thought the call was off the record was not helpful. Bannon’s departure leaves a major void in the White House, depriving it of a man once seen as Cardinal Richelieu in cargo pants, an unkempt schemer adept at manipulating the president, who was famously depicted as a childlike naif to his aide’s Grim Reaper in a Saturday Night Live sketch. The characterization – summed up in a Time magazine cover that hailed “the great manipulator” – reportedly annoyed the famously thin-skinned president and contributed to his fall from grace. Josh Green, the author of the book Devil’s Bargain about Bannon and Trump, told the Guardian: “Bannon may be the only person in the White House with clear and distinct politics of his own.” His absence means more power and influence for figures such as Trump’s son-in-law Jared Kushner and the national economic council chair, Gary Cohn, who have few, if any, ideological ties to the Republican party and the conservative movement. Bannon has long occupied an unusual position in the White House. In an administration that one outside ally compared to Baskin Robbins, “composed of 31 flavors,” Bannon represented “the nationalist Trump coalition” as opposed to “a lot of people that were not only not Trump supporters but anti-Trump people”. One Bannon ally told the Guardian that the West Wing had seen a “four-on-one fight” recently, with Bannon taking on a coalition of Kushner, Ivanka Trump, Cohn and national security adviser HR McMaster. In the ally’s eyes Bannon represented the populist “burn it all down” path while others in the administration wanted Trump to “move the center” and work with the establishment. A White House source claimed to Axios: “His departure may seem turbulent in the media, but inside it will be very smooth. He has no projects or responsibilities to hand off.” Bannon had also stood out as the lone White House staffer to defend Trump’s comments on Charlottesville in recent days.

A bizarre interview that Bannon gave to the liberal magazine the American Prospect – in which he claimed there was no military solution for North Korea, called the far right a “collection of clowns”, and said the left’s focus on racism would allow him to “crush the Democrats” – may have altered the balance of the power inside the West Wing. For an aide long suspected of leaking freely about rivals, Bannon’s excuse that he thought the call was off the record was not helpful. Bannon’s departure leaves a major void in the White House, depriving it of a man once seen as Cardinal Richelieu in cargo pants, an unkempt schemer adept at manipulating the president, who was famously depicted as a childlike naif to his aide’s Grim Reaper in a Saturday Night Live sketch. The characterization – summed up in a Time magazine cover that hailed “the great manipulator” – reportedly annoyed the famously thin-skinned president and contributed to his fall from grace. Josh Green, the author of the book Devil’s Bargain about Bannon and Trump, told the Guardian: “Bannon may be the only person in the White House with clear and distinct politics of his own.” His absence means more power and influence for figures such as Trump’s son-in-law Jared Kushner and the national economic council chair, Gary Cohn, who have few, if any, ideological ties to the Republican party and the conservative movement. Bannon has long occupied an unusual position in the White House. In an administration that one outside ally compared to Baskin Robbins, “composed of 31 flavors,” Bannon represented “the nationalist Trump coalition” as opposed to “a lot of people that were not only not Trump supporters but anti-Trump people”. One Bannon ally told the Guardian that the West Wing had seen a “four-on-one fight” recently, with Bannon taking on a coalition of Kushner, Ivanka Trump, Cohn and national security adviser HR McMaster. In the ally’s eyes Bannon represented the populist “burn it all down” path while others in the administration wanted Trump to “move the center” and work with the establishment. A White House source claimed to Axios: “His departure may seem turbulent in the media, but inside it will be very smooth. He has no projects or responsibilities to hand off.” Bannon had also stood out as the lone White House staffer to defend Trump’s comments on Charlottesville in recent days. Friday, December 13, 2013

Greek deflation rate hits new high

Greece has lurched further into deflation, with prices tumbling at the fastest rate recorded as the country's long economic slump continues.

The Greek consumer prices index shrank by 2.9% in November, showing deflation accelerated after October's reading of minus 2.0%.

Prices in Greece have been falling steadily over the last three years, hitting deflation in April for the first time since records began in the 1960s.

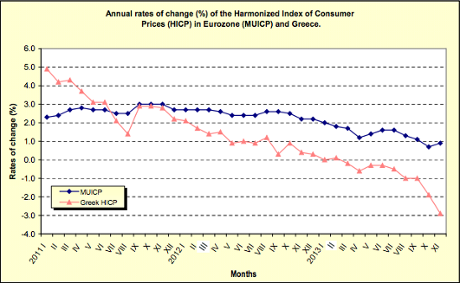

This graph tracks Greek CPI (red) against eurozone inflation (blue):

Today's data shows that some retailers have slashed prices drastically, having seen demand slide among customers buffeted by austerity cutbacks and record unemployment.

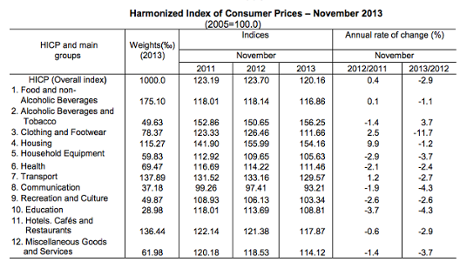

Clothing and textile prices tumbled by over 11%, according to national statistics body ELSTAT. Household equipment costs were down 3.7% year-on-year, as this chart shows:

Greece's austerity programme has forced wages and pensions down in an attempt to boost competitiveness -- so deflation has not come as a surprise. It could even be taken as a sign that the Troika's plan is having its intended effect.

The damage wrecked on the wider Greek economy rather undermines the argument that deflation's a good thing, though, especially as Athens isn't able to inflate away some of its national debt.

We've also heard confirmation this morning that the Greek economy shank by 3% on a year-on-year basis in Q3, which confirms that the five-year recession is easing.

Sunday, November 17, 2013

Hopefully, in their blind obedience to Merkel and co, the amazingly stupid and corrupt EU Commission will have gone yet another step too far. IF You are Italian or Spanish and you read the headline in your local paper that the EU wants to make you poorer and take more power to themselves from your Government...I think ropes and lamposts are in order for the EU Commissioners if they go much further.

Germany's status as Europe’s industrial powerhouse could be damaging the single-currency bloc, the European Commission has said, as it launched a probe into whether the country’s large trade surplus was hindering Europe’s recovery. Europe’s biggest economy was one of three countries singled out for an “in-depth review” by the EC’s Alert Mechanism Report on Wednesday. The Commission said Germany’s large current account surplus, which accounts for most of the eurozone’s positive balance, “may put pressure on the euro to appreciate vis-à-vis other currencies. “In case such pressures materialise, this would make it more difficult for the peripheral countries to recover competitiveness through internal depreciation,” it said. However, Brussels insisted it was not criticising Germany’s economic success. “The issue is whether Germany ... could do more to help rebalance the European economy,” said Jose Manuel Barroso, the president of the EC. Olli Rehn, commissioner for economic and monetary affairs, added: “Let’s be clear, we are not criticising Germany’s external economic competitiveness or its success in global markets, in fact that is what we want from all EU member states,” However, Mr Rehn said Germany’s “persistent high surplus also means that Germans are persistently investing a large part of their savings abroad. The question is whether this is efficient, even from the German perspective.” The EC also fired a warning shot at Britain, and said rising house prices would restrain households’ ability to cut debt. The Commission highlighted Britain’s unbalanced recovery. According to Eurostat, Britain’s share of world exports declined by 19pc between 2007 and 2012. The EC said levels of Government debt in UK remained a concern, while the “ongoing balance sheet repair of the financial sector and the persistent scarcity of credit for smaller firms may continue to hold back economic growth.” EC data last week predicted Britain’s commercial deficit will be the highest in a quarter century next year, at 4.4pc of GDP. Meanwhile, low-tax, banking-rich Luxembourg, and Croatia, which accepted a bailout this year, were also added to the EC’s watch list.

Monday, October 21, 2013

WSJ - Ireland's economy slid into crisis in 2008 when the bursting of its property

bubble wrecked the country's banks and brought the euro-zone member close to

bankruptcy. In late 2010, the government secured €67.5 billion ($91.54 billion)

in loans from the EU and IMF, the last of which will be disbursed over the next

two months. From next year, the government will have to finance itself

exclusively through the bond markets. Finance Minister Michael Noonan told lawmakers that the budget will introduce

up to €2.5 billion in new tax increases and spending cuts, saying that Ireland

will better the deficit target for 2014 that was set under its bailout

agreement. The proposed cuts are the smallest since 2008. Under the budget, the deficit is planned to fall to 4.8% of gross domestic

product in 2014 from 7.3% this year. The government is committed to reducing its

deficit to below 3% of GDP in 2015. Required to keep cutting its deficit over the next two years, Ireland's

government will then be obliged to endure a tight regime of fiscal oversight for

many more years to cut its towering national debt. Despite those constraints, Mr. Noonan told lawmakers that in ending its

dependence on EU and IMF loans, the nation would regain control over its own

destiny.

WSJ - Ireland's economy slid into crisis in 2008 when the bursting of its property

bubble wrecked the country's banks and brought the euro-zone member close to

bankruptcy. In late 2010, the government secured €67.5 billion ($91.54 billion)

in loans from the EU and IMF, the last of which will be disbursed over the next

two months. From next year, the government will have to finance itself

exclusively through the bond markets. Finance Minister Michael Noonan told lawmakers that the budget will introduce

up to €2.5 billion in new tax increases and spending cuts, saying that Ireland

will better the deficit target for 2014 that was set under its bailout

agreement. The proposed cuts are the smallest since 2008. Under the budget, the deficit is planned to fall to 4.8% of gross domestic

product in 2014 from 7.3% this year. The government is committed to reducing its

deficit to below 3% of GDP in 2015. Required to keep cutting its deficit over the next two years, Ireland's

government will then be obliged to endure a tight regime of fiscal oversight for

many more years to cut its towering national debt. Despite those constraints, Mr. Noonan told lawmakers that in ending its

dependence on EU and IMF loans, the nation would regain control over its own

destiny.

"We have a fair wind at our backs to achieve our objectives and to restore

our sovereignty," he said.

After the long years of sacrifice, the government is seeking to shore up

faltering public support for austerity, describing its 2014 budget as one of the

last of the big painful efforts to move the country out of crisis and into

recovery. The leaders of the two parties in the coalition government have said

there is now clear evidence that the country is emerging from its "national

emergency."

There is much at stake for the euro zone, which has also provided bailouts to

Greece, Portugal, Cyprus and Spain. A successful return to the bond markets for

Ireland would offer euro-zone policy makers a rare opportunity to claim a

success for their much-criticized strategy for confronting the currency area's

fiscal and banking crisis, one that has relied heavily on austerity.

Mr. Noonan said that for the first time since the onset of the financial

crisis, the government will post a primary budget surplus next year. That would

mean that excluding interest payments, its tax revenues would exceed its

spending, helping to cap its huge debts.

Tuesday's budget means that since 2008, Ireland has detailed cuts to its

budget totaling a cumulative €30 billion, representing about 18.5% of the

country's annual economic output and making it one of the largest austerity

programs undertaken anywhere in the aftermath of the financial crisis.

The EU and IMF and other institutions, such as the Irish Fiscal Advisory

Council and the Irish central bank, had urged the government to go further and

meet in full a proposed €3.1 billion in deficit cuts, to safeguard its finances.

But the coalition projects that it will still meet its bailout budget targets in

2014 and 2015, and help promote jobs.

Saturday, September 21, 2013

Merkel does put German interest above European interest. But that's not the

whole story. She also puts German corporate interest above German public

interest. And most of all, her own interest above anything else.

Merkel does put German interest above European interest. But that's not the

whole story. She also puts German corporate interest above German public

interest. And most of all, her own interest above anything else.

I understand people in Germany being upset about everyone in Europe wanting

their tax money. But that's only half the truth. The other half is, Germany

profits from investors taking back their money from other European countries,

and now investing it in the much safer and quite profitable Germany. Our

interest rates in Germany have reached an all-time low in the crisis, so German

economy profits from this crisis. And we still live from exports, and so from the EU. German economic interest

is: try to keep up the status quo as long as possible, and that is what Merkel

does.

Problem is, in my opinion, that will be disastrous for Europe. Polemics

aside, the south europeans have a point. There's need for reforms, there's need

for savings, but there also needs to be a perspective. You can't just close

schools, hospitals, stop investments in infrastructure and deny people their

healthcare for nothing in return but a lack of perspective. Just fire everyone

from public service and don't offer any alternative for them. You can't just

sacrifice the future of countries and societies for nothing but the need to save

money.

It almost seems like Britain was right in its Euro-scepticicm. And everyone

who was afraid of a too strong Germany after its reunion. That doesn't mean we

should split up. In present and future, we simply have no choice but to work

together in Europe. We're all in the same boat. If Britain wasn't in the

European boat, few would care about it anymore. UKIP is wrong, British interest

has to be in a strong Europe, not in a lone Britain.

Our unpopular former chancellor Gerhard Schröder made the reforms that led to

present German economic strength. He risked his chancellorship, against his own

party, to put through inevitable reforms. He turned the inert giant into an

economic powerhouse. Merkel hardly does anything, the economic success she rests

on was caused by her predecessor who took great risks. Risks that Merkel would

never take. She's not the risky type. Schröder made reforms that were in parts

flawed, but his own party, the SPD, is willing to work with and against the

flaws today. Merkel is nothing like that. Her own influence is everything, and

everything else plays second role, be it Germany, be it Europe.

Chancellor Schröder would have forced similar reforms on those countries, but

he would have tried to convince them. Something like "it's going to be hard, but

we're in the same boat, and we need to work together to get out of the crisis

with greater strength". Even if it would damage his reputation in Germany.

Merkel doesn't care about that. She simply says: "it's inevitable, deal with it.

German savings are secure, I don't care a lot about the rest of Europe". She

only cares about her position. And her position doesn't depend on Greece, Italy,

Spain, or Britain. It only depends on Germans wanting to keep their money, and

German economy, which is, again, profiting from the Euro crisis.

I am convinced that will destroy Europe, and I will vote for her adversary

this month, but I have very little hope in a regime change. My hope is for a

large coalition in which the SPD will have a little bit of influence on her

Europe policy. A Europe policy, that is, contrary to her claims, careless and

heartless.I find the idea that a German chancellor is responsible for solving

the European economic crisis quite ridiculous. It is not in her powers to do so

as she is no monarch but the democratically elected head of the German

government. To all those moaning about her putting Germany's interest first -

well that's actually her job description. That means, that she will, quite free

of any ideological leaning decide hand in hand with the German industry what

should be pursued for Eurozone. Be the next chancellor Steinbrueck or Merkel,

nothing will change that.

Monday, May 27, 2013

Hey Mario: what part of "FUCK OFF" don't you undestand.

EUROSMOKE AND LIES - “The answer to the crisis has not been less Europe but more Europe... The EU and

the [euro] are no exceptions. The choice is between adapting them to the new

conditions or do nothing and risk their dissolution.” The EU is a body

primarily driven by pure politics without any ameliorating rational input from

experts in economics markets science etc. Both the creation of the Eurozone and

the FTT were political projects making extensive use of confirmation bias and

totally ignoring expert advice. The Eurozone is a failure and the FTT will kill

off the City as well as destroy markets inside the EU which both sovereign

states and EU companies rely on. Politicians and bureaucrats taking the

decision have never even heard of the repo market but they are about to find out

how important it was once they destroy it. Rational thought would mean taking

account of the views of experts on the FTT but the FTT is a political dream

where there is no room for reality. If there was there would be no FTT. Any

organization run by purely political decisions is going to lose out against a

more rational response elsewhere in the world. I doubt the EU will ever base its

decisions on rational thought processes rather than politics as there is no

mechanism in place to force elite politicians to take note of experts. In their

conceit they only see their own narcissistic beliefs as relevant to decision

taking. Confirmation bias means that politicians start by already knowing the

answers and see the job as putting their irrational policies in place. When

policies do not work in the real world confirmation bias is called upon again to

warp data to explain failure without ever seeing any need to change policy.

Failure followed by more failure is guaranteed by the political approach.

Pressure from the UK public to leave will increase noticeably once the FTT is in

place and the City goes down the tubes. This will be extensively reported by the

media. How often have we heard this before? You will never convince the average

Brit that having more decisions taken by the unelected elite in Brussels is

going to deliver anything for us. The nearer you get to a EUSSR the less the

Brits will like it and the more we will want to leave. We have a totally

different mentality to the majority of the EU who think that taking all

decisions centrally will lead to economic success. That idea is seen as rubbish

here and unworldly. To work in the real world the people taking the decisions

would have to real experts in many fields and driven by rationality instead of

politics. That can never happen in the EU as it is a political construct.

Instead decisions are from over-conceited politicians and bureaucrats whose

knowledge and understanding of the real world is minimal. Whatever Draghi says

about banking reform will be politically based and not based on research by

experts. The starting point always has to be 'more EU' whereas it is unlikely in

the real world that all answers would come out to be simply as case of more EU

solving the problem. That is illogical. Draghi : "If we are successful in

establishing (a federal Europe) as I am sure we will be..." "Europe is much more

stable today (thanks to me)..." There you have it. Breathtaking arrogance

combined with delusion. The only option we have is to gtf away from pr!cks like

this.

Tuesday, April 9, 2013

Hmmm...I wonder what would the master EU idiot - Ollie R. say about this ...

Telling people that they can lose their deposits, even possibly below guaranteed amount (100,000 euros), which later was retracted, had not been a mistake. Firstly people realized and got used to the idea that such thing was no longer unthinkable. Secondly, by hitting deposits above 100,000 euros with up to 40% (or even maybe up to 60%) tax, it was made clear that such hit can be very hard indeed. Not some 6.75% or 9.9% as originally mooted: so now it is matter for the 'financial markets' to extend their target, below 100,000 euros. It is indeed a very primitive piece of social engineering and coaching people for the forthcoming loss. It is preparing psychologically all countries in Europe for the next step of the largest heist in history: direct and hard targeting of people's deposits. There is also a rather ironic twist in the events in Cyprus. It has been widely reported that many billions of euros held in banks in Cyprus came from all sorts of dodgy businesses (Russia?). There is even a whispering subliminal propaganda designed to make it easier to accept this new phase of the largest heist in history. The message is that there is nothing wrong in stealing money from the thieves.

Telling people that they can lose their deposits, even possibly below guaranteed amount (100,000 euros), which later was retracted, had not been a mistake. Firstly people realized and got used to the idea that such thing was no longer unthinkable. Secondly, by hitting deposits above 100,000 euros with up to 40% (or even maybe up to 60%) tax, it was made clear that such hit can be very hard indeed. Not some 6.75% or 9.9% as originally mooted: so now it is matter for the 'financial markets' to extend their target, below 100,000 euros. It is indeed a very primitive piece of social engineering and coaching people for the forthcoming loss. It is preparing psychologically all countries in Europe for the next step of the largest heist in history: direct and hard targeting of people's deposits. There is also a rather ironic twist in the events in Cyprus. It has been widely reported that many billions of euros held in banks in Cyprus came from all sorts of dodgy businesses (Russia?). There is even a whispering subliminal propaganda designed to make it easier to accept this new phase of the largest heist in history. The message is that there is nothing wrong in stealing money from the thieves.  Technically what happened there was that the billions of euros in cash deposited in Cyprus was used to redeem for a lot of toxic waste of the financial institutions (it is called 'making investments' in a financial language, with depositors cash). So, as expected, those who had cash ended up with nothing and those who held (and are still generating) zillions of toxic waste, got another tranche of their heist. The largest heist in history continues. Now...if it is true, as it is widely rumored, that many billions of euros of mafia money have been kept in Cyprus and now something like 40% or even 60% are going to be lost, one could wonder whether European politicians, central bankers, who drive this process, e.g. finance ministers, or some other decision makers, even lower down the chain, are going to sleep comfortably. Or are they going to think more about their own and their families safety? Is mafia going to accept such multibillion euros loss? Or would they plan to teach a lesson in order to get their money back, to get a compensation for the current 'inconvenience' and mess and to make sure such a thing is unthinkable in the future. Mafia starts wars when there is big money at stake. And in Cyprus some powerful groups lost billions of euros. Therefore we can also look forward to listen to some interesting news. Don't be surprised.

Technically what happened there was that the billions of euros in cash deposited in Cyprus was used to redeem for a lot of toxic waste of the financial institutions (it is called 'making investments' in a financial language, with depositors cash). So, as expected, those who had cash ended up with nothing and those who held (and are still generating) zillions of toxic waste, got another tranche of their heist. The largest heist in history continues. Now...if it is true, as it is widely rumored, that many billions of euros of mafia money have been kept in Cyprus and now something like 40% or even 60% are going to be lost, one could wonder whether European politicians, central bankers, who drive this process, e.g. finance ministers, or some other decision makers, even lower down the chain, are going to sleep comfortably. Or are they going to think more about their own and their families safety? Is mafia going to accept such multibillion euros loss? Or would they plan to teach a lesson in order to get their money back, to get a compensation for the current 'inconvenience' and mess and to make sure such a thing is unthinkable in the future. Mafia starts wars when there is big money at stake. And in Cyprus some powerful groups lost billions of euros. Therefore we can also look forward to listen to some interesting news. Don't be surprised.

Labels:

A.M.Press,

agenda de business,

Agerpress Amos News,

Amos News,

antena3.ro,

anunturi,

bailout,

Bank of England banks,

Basa Press,

fmi,

idiot,

Mondiala,

Ollie rehn,

ziare.com,

ziare.ro,

zona euro

Saturday, April 6, 2013

Eurozone crisis hits development

funds - The eurozone crisis is having far-reaching effects, not least on the aid

being sent to the developing world. Deep cuts in aid budgets by crisis-stricken euro zone countries have prompted

the biggest fall in development assistance to the world’s poorest nations since

the mid-1990s. Sharp drops in spending by Spain, Italy, Greece and Portugal

resulted in a 4% decline in financial assistance to the developing world in

2012, according to the annual assessment conducted by the Organisation for

Economic Cooperation and Development. The OECD, a club for 33 rich nations,

said it was concerned by the decline, which it blamed on the austerity

programmes forced on many euro zone countries over the past three years. After

a 2% drop in 2011, the decline in 2012 was the biggest in 15 years and was the

first back-to-back drop in development assistance since 1996-97 - the years

immediately before the mass public campaigns in the West for debt relief and

increased development assistance.

Eurozone crisis hits development

funds - The eurozone crisis is having far-reaching effects, not least on the aid

being sent to the developing world. Deep cuts in aid budgets by crisis-stricken euro zone countries have prompted

the biggest fall in development assistance to the world’s poorest nations since

the mid-1990s. Sharp drops in spending by Spain, Italy, Greece and Portugal

resulted in a 4% decline in financial assistance to the developing world in

2012, according to the annual assessment conducted by the Organisation for

Economic Cooperation and Development. The OECD, a club for 33 rich nations,

said it was concerned by the decline, which it blamed on the austerity

programmes forced on many euro zone countries over the past three years. After

a 2% drop in 2011, the decline in 2012 was the biggest in 15 years and was the

first back-to-back drop in development assistance since 1996-97 - the years

immediately before the mass public campaigns in the West for debt relief and

increased development assistance.

Over to Italy, where the treasury has cut its growth

expectations, just two weeks after the last forecasts. Treasury

undersecretary Gianfranco Polillo said the economy is likely to contract

by 1.5% and 1.6% this year. Speaking to Radio 24, he said: This year

we will see a fall in gross domestic product of 1.3% if things go well, but it

will probably be -1.5% or -1.6%. The currency bloc's third largest economy has

shrunk for six consecutive quarters, its longest recession in 20 years. Mario

Monti's outgoing government slashed this year's forecast to -1.3% last moth from

its previous estimate of -0.2%.

Wednesday, January 30, 2013

In a short televised speech, the Dutch Queen said it was time to

place the nation “in the hands of a new generation”.

In a short televised speech, the Dutch Queen said it was time to

place the nation “in the hands of a new generation”.

Queen Beatrix turns 75 in just a few days and is already the country’s oldest

ever monarch. Both her mother, Queen Julianna, and her grandmother, Queen

Wilhelmina, also abdicated and the Dutch do not see being king or queen as a job

for life.

“I am not abdicating because this office is too much of a burden, but out of

conviction that the responsibility for our nation should now rest in the hands

of a new generation,” Queen Beatrix said, in a speech delivered from her Huis

ten Bosch palace.

“I am deeply grateful for the great faith you have shown in me in the many

years that I could be your Queen,” she added.

The Dutch Queen praised her eldest son, Prince Willem-Alexander, as a

talented and capable successor 'fully prepared’ for his future role. As a history buff I can tell you that when Germany invaded the Netherlands in

WW2 the Dutch Royal family fled to England under the sanctuary of the British

King George VI and his Parliament and were safely tucked away in Ottawa Canada

for the duration of the war and until all the nastiness was over.

Unlike the

British Royal Family who were duty bound to remain in Britain throughout the

Blitz and the threat of invasion.

The Netherlands were liberated by British

and Canadian troops

in 1945 and since the Germans let the Dutch citizens

starve sooner than capitulate or surrender the Allies even airlifted much food

stuffs to the starving Dutch. Since the Dutch are considered Volks to the very

similar Germans there was much collaboration with many Dutch who welcomed Hitler

and there was not very much resistance at all until after the June Allied

landing in 1944.

The Allies were prompt to bring this Dutch Royal Family

and reinstate them and return to status quo and use this Royal group as a

rallying point should the Russians rumble across Western Europe or worse

scenario the starving Dutch might go Communist,so let`s rebuild with the

Marshall Plan-shrewd and clever how Capitalism works.

Saturday, October 20, 2012

European leaders early Friday agreed to have a new supervisor for euro-zone banks up and running next year, a step that will pave the way for the bloc's bailout fund to pump capital directly into banks throughout the single-currency area......

Friday's announcement is a disappointment for some officials at the European Commission, the EU's executive arm, who had hoped to have the supervisor operational at the start of 2013.

The leaders also discussed plans for a common budget for the 17 euro-zone nations that could be used to absorb economic shocks impacting one part of the euro zone but not others. But José Manuel Barroso, the commission president, said: "This is something for the medium and longer term.

The man who died in Greece :

The death came as protesters lobbed flares, petrol bombs and chunks of marble at lines of riot police, who responded with tear gas and stun grenades, in confrontations which have become all too familiar in the Greek capital over the last three years.

Friday's announcement is a disappointment for some officials at the European Commission, the EU's executive arm, who had hoped to have the supervisor operational at the start of 2013.

The leaders also discussed plans for a common budget for the 17 euro-zone nations that could be used to absorb economic shocks impacting one part of the euro zone but not others. But José Manuel Barroso, the commission president, said: "This is something for the medium and longer term.

The man who died in Greece :

The death came as protesters lobbed flares, petrol bombs and chunks of marble at lines of riot police, who responded with tear gas and stun grenades, in confrontations which have become all too familiar in the Greek capital over the last three years.

The clashes erupted in and around Syntagma Square, in front of parliament,

during protests against a new wave of austerity cuts that the government plans

to introduce in November.

"A 65-year-old man was taken to hospital where efforts to revive him

failed," a health ministry official told the AFP news agency.

One report said the man had been found dead in Syntagma Square while

another said he was found on a bench several hundred yards from the violence.

Friday, October 12, 2012

The yield on Spanish 10-year government bonds rose sharply Tuesday back above

6pc for the first time in over a week following a meeting of eurozone finance

ministers where there was no movement on a possible Spanish bailout.

The yield on Spanish 10-year government bonds rose sharply Tuesday back above

6pc for the first time in over a week following a meeting of eurozone finance

ministers where there was no movement on a possible Spanish bailout.

In early trading the yield rose to 6.095pc on the secondary market, compared

to 5.714pc at Monday's close. It had been below 6pc, a level considered by many

economists to be unsustainable in the long term, since September 28.

"At the Eurogroup meeting, no progress was made on other 'hot' topics which

gather attention today, chief among them being the expected request by the

Spanish government for a precautionary credit line from the ESM," said Credit

Agricole economist Slavena Nazarova.

The eurozone on Monday unlocked

its €500bn crisis war chest, the European Stability Mechanism (ESM) as Spain

agonised over whether to seek a full bailout.

Spain's heavy debt refinancing burden and high borrowing costs are widely

expected to force it to seek a bailout soon, with market pressure likely to rise

on Madrid as it faces some 30 billion euros in repayments this month.

Wednesday, September 26, 2012

The EU is dead in the water....

The EU is dead in the water already, the Euro and Eurozone even more so. Or

perhaps you think the whole mad caboodle is a roaring success, and on an

ever-upwards curve? Who cares when it finally unravels - it will, by its nature,

never be a success in the future, because its structure and aims are stuck in

the past in a fast-changing world. UKIP were top in the EU elections, and have

gained significant success in the polls ever since the last General Election, so

much so that they are challenging the Limp Dicks for third place. Most

Conservatives agree privately with UKIP, and significant numbers have deserted

to UKIP, so much so that the Conservatives cannot possibly win the next General

Election without UKIP aid or without adopting UKIP policies in a significant

fashion. There's a message for you there, chum. There is a great irony here

that the steps taken in order to prevent a deflationary collapse could mean

there is an even greater "danger" if we do start to recover. Put simply, the

debt burden of the major economies are so large that they cannot afford to pay

higher rates. The central banks, have massive rate risk through the bonds they

are holding. What we are trying to do is create via financial alchemy a

solution to the problem that the debtors cannot pay the creditors, but a

restructuring is politically impossible as well as a mortal threat to

undercapitalized banks. Therefore, we hope that we can somehow flood the world

with liquidity, to inflate only specific assets (property, equities) but not

others (food and energy). Because this is "unnatural" we see efforts made to

manipulate markets (officially sanctioned fudges of housing data, outright

equity market intervention, and rumors of oil releases) so the markets just get

weirder every day. The question is, whether we are happy to live in a world of

extreme central planning, which seems to benefit the ultra wealthy the most or

would be prefer to stop the charade, allow the markets to clear, accept the

reality that we are not as rich as we thought, but move on.

The EU is dead in the water already, the Euro and Eurozone even more so. Or

perhaps you think the whole mad caboodle is a roaring success, and on an

ever-upwards curve? Who cares when it finally unravels - it will, by its nature,

never be a success in the future, because its structure and aims are stuck in

the past in a fast-changing world. UKIP were top in the EU elections, and have

gained significant success in the polls ever since the last General Election, so

much so that they are challenging the Limp Dicks for third place. Most

Conservatives agree privately with UKIP, and significant numbers have deserted

to UKIP, so much so that the Conservatives cannot possibly win the next General

Election without UKIP aid or without adopting UKIP policies in a significant

fashion. There's a message for you there, chum. There is a great irony here

that the steps taken in order to prevent a deflationary collapse could mean

there is an even greater "danger" if we do start to recover. Put simply, the

debt burden of the major economies are so large that they cannot afford to pay

higher rates. The central banks, have massive rate risk through the bonds they

are holding. What we are trying to do is create via financial alchemy a

solution to the problem that the debtors cannot pay the creditors, but a

restructuring is politically impossible as well as a mortal threat to

undercapitalized banks. Therefore, we hope that we can somehow flood the world

with liquidity, to inflate only specific assets (property, equities) but not

others (food and energy). Because this is "unnatural" we see efforts made to

manipulate markets (officially sanctioned fudges of housing data, outright

equity market intervention, and rumors of oil releases) so the markets just get

weirder every day. The question is, whether we are happy to live in a world of

extreme central planning, which seems to benefit the ultra wealthy the most or

would be prefer to stop the charade, allow the markets to clear, accept the

reality that we are not as rich as we thought, but move on.Sunday, September 23, 2012

Difficulties in the markets for Spain, a slippery slope towards a bailout,

austerity, protests and social unrest, we have seen this movie before. Here is

my a guide for how to deal with the situation.

Difficulties in the markets for Spain, a slippery slope towards a bailout,

austerity, protests and social unrest, we have seen this movie before. Here is

my a guide for how to deal with the situation.

An ancient Greek guide for Spanish and other PIIGS who wish to deal

effectively with the crisis

1. Dealing in private with the pain and anxiety caused by the market turmoil

and/or frequent visits of the Troika and their impossible demands (for how to

deal in public see other points below): Draw from Stoicism. Stoics

strived to be free of suffering and through exercise of reason achieve peace of

mind - meant in the ancient sense of having "clear judgment" – as well as

maintain equanimity in the face of life's highs and lows.

2. Dealing with “nice” comments about your morality: Use Aristotelian or

Chryssipian logic. Convince yourself with sound deductive syllogisms that

the rubbish posted around the world about your country & culture is the

result of incorrect induction and reckless stereotyping (one pig does this, two

pigs do this, therefore all pigs do this).

3. Dealing with the unethical behaviour of political and economic elites in

your country and the abroad: Adopt Socratic dialectic and ethics in

public life. Socrates was renowned for his relentless questioning of authorities

and public figures, which was aimed not to humiliate individuals (yeah sure –

never swallowed this at school) but to discover truth with a view to achieving

the “good life” for everyone.

4. Dealing with seemingly endless half-baked attempts to re-establish

financial stability: Recall Zenon’s paradoxes especially the one of

Achilles and the Tortoise. If the Tortoise is given advantage in the race,

Achilles will never reach her because by the time he has reached the last

position, the Tortoise will always have moved a bit further.

5. Dealing with debt slavery: Recall σεισάχθεια (seisachtheia), Prior

to Solon (5th cent BC) Athenians practiced debt enslavement: a citizen

incapable of paying his debts became "enslaved" to the creditor. This issue

primarily concerned peasants working leased land belonging to rich landowners

and unable to pay their rents. In theory, those enslaved would be liberated when

their original debts were repaid. Solon put an end to it with the σεισάχθεια /

seisachtheia, liberation of debts, which prevented all claim to the person by

the debtor.

6. Finally, if you fail to bring about the much desired relief or political

change with the above measures why not go for a Roman style “Spartacus

slave revolt” and then establish “Epicurean philosophical communes” all

over the Med. They survived for hundreds of years in antiquity and provided

peace and happiness to millions.

Thursday, August 9, 2012

I have yet to meet any French or Germans who want to keep the Euro.

Germany led the way with regard to the Euro, due mainly to the enormous

financial benefits it would reap. There is no problem with that if we accept

that nation states should act in their own best interest...."Bundestag president

Norbert Lammert said parliament’s integrity cannot be subordinated to the ups

and downs of the markets. Free Democrat (FDP) leaders said Italy’s unelected

prime minister is playing with political fire by trying to circumvent democratic

legitimacy.

Germany led the way with regard to the Euro, due mainly to the enormous

financial benefits it would reap. There is no problem with that if we accept

that nation states should act in their own best interest...."Bundestag president

Norbert Lammert said parliament’s integrity cannot be subordinated to the ups

and downs of the markets. Free Democrat (FDP) leaders said Italy’s unelected

prime minister is playing with political fire by trying to circumvent democratic

legitimacy.

The dispute comes as relations between Germany and Italy touch the lowest ebb

since the Second World War, with Il Giornale publishing a front-page

picture of Chancellor Angela Merkel under the headline “Fourth Reich”. "..This

is funny... the Germans complaining about Mr Monti not being elected... He was

elected... by Merkel and Sarkozy!!! and their puppy Barroso...Wait for

Berlusconi to come back with a proper election in Italy and see where you are

with your Euro! However, Germany now insists that there must be financial union

to support this currency; but on Germany's terms, and with no risk to their

financial systems. It is not good enough to state that they are paying for the

bailouts - the idea of the EU is that all are equal and it is their DUTY to give

this support. If they believe differently then they can hardly be called "good

europeans".The euro, as predicted from the very beginning, has proved to be in

nobody's long-term interests; it gave a short term limited boost to to weaker

economies but has ended up being the agent of destruction for their economies.

It was only ever the zealot's attempt to create the EUSSR as a single country.

Well, hell mend them. Let it go and stop pouring good money after bad keeping it

up. I've yet to meet any French or Germans who want to keep the Euro.

Saturday, August 4, 2012

I bet even the IMF has no idea how much the game is going to change.

President Mario Draghi admitted his eurozone rescue plan was a work in progress. ... First there was light at the end of the tunnel - now there is just work in progress meaning that they are thinking of trying to locate where they are in the tunnel but they haven't got a clue what to do. Euro is just a shamble the biggest political failure of all times, the biggest wealth destroyer the humanity has ever known. Congratulations to the europhiles for making the world a poorer place. You're in a big hole and you're still digging.... There is a need for the europhiles for an apology for all the misery they piled onto the people and start urgent negotiations on how to get rid of the euro. We will forget all your sins. It is up to you to put your hands up and say sorry. wELL :The elephant in the room is losing it's grip on the ceiling light flex? Stand by for the mass stampede through doors and windows and walls. The IMF is as informed as manuel as to the whole picture, the truth is nobody can know the extent of the desolation bankers and financial whizzkids have visited upon us and anyone who can be convinced otherwise has little appreciation of the shortcomings of human nature. It's likely that from top to bottom they were all behaving with the mindset of the shoplifters during the riots, driven mad in their bonus rush, many also under the influence of cocaine?

President Mario Draghi admitted his eurozone rescue plan was a work in progress. ... First there was light at the end of the tunnel - now there is just work in progress meaning that they are thinking of trying to locate where they are in the tunnel but they haven't got a clue what to do. Euro is just a shamble the biggest political failure of all times, the biggest wealth destroyer the humanity has ever known. Congratulations to the europhiles for making the world a poorer place. You're in a big hole and you're still digging.... There is a need for the europhiles for an apology for all the misery they piled onto the people and start urgent negotiations on how to get rid of the euro. We will forget all your sins. It is up to you to put your hands up and say sorry. wELL :The elephant in the room is losing it's grip on the ceiling light flex? Stand by for the mass stampede through doors and windows and walls. The IMF is as informed as manuel as to the whole picture, the truth is nobody can know the extent of the desolation bankers and financial whizzkids have visited upon us and anyone who can be convinced otherwise has little appreciation of the shortcomings of human nature. It's likely that from top to bottom they were all behaving with the mindset of the shoplifters during the riots, driven mad in their bonus rush, many also under the influence of cocaine? Over four years some of the known truth has been drip fed out, it's rumsfeldt's unknown unknowns (as it were) that will lock in the longest depression yet, as we especially seem stuck with the present establishment using the austerity argument totally dishonestly for dogmatic gains and repression.... I SAY : The economic shock from the eurozone crisis has not yet hit said the IMF- AND That's because it ISN'T a "eurozone crisis", it's a crisis of western consumer 'growth' capitalism, mainly caused by a bubble stoked by profligate bank lending activities, reckless and stupid corporate borrowing and a disastrous corporate 'globalisation' process which saw the biggest transfer of wealth across the globe in human history - oh, and diminishing conventional oil reserves.

Top bankers messed up, top business leaders gave away the wealth of the west for short term profit and dumb politicians didn't understand what was going on. Those that did, were easily 'persuaded'. They're all sliding down the mountain side, using ice picks for brakes but kicking the Eurozone ahead of themselves, so that they have someone to blame....it called for a "policy game changer"

I bet even the IMF has no idea how much the game is going to change.

Tuesday, July 24, 2012

Bank secrecy masks a world of

crime and destructionBanks seem willing to exploit the loopholes found in tax

havens and it's costing the British taxpayer dear" (source: the guardian)…If

anybody has actually read any of my postings and comments, which is not at all

certain since I do not read other blogs, posts and comments, they will have

seen how I have been advocating the end of Tax Havens and fancy avoidance

schemes for years. I have been saying we are in a world war: the 1% against the

99%. It was in my report sent to Governments in 2009: A MORAL PATH TO RECOVERY,

which can still be read on my blog's archived posts, I maintain that Wealth Management, offered by

the big banks, is code word for tax evasion on a massive scale. It has grown

into a major industry of the rich for the rich, by the rich actually sponsored

by Governments which have allowed the privileged elite to avoid paying taxes.

And we wonder why our countries are in debt and the economies stagnating. The

banks have been exposed as virtually corrupt, fraudulent, criminal

organizations and yet not one single banker has been brought to justice. The 13

trillion dollars hidden away as calculated by the Tax Justice Network simply

must be recovered if Europe and America are to survive as democracies. The 99%

just cannot support any more austerity measures, cut backs and increased taxes.

That is the simple choice we face. The 1% know they cannot hold out for ever

but they seem too shortsighted to understand that if the majority sinks they

will go down too....Well, as long as we allow banks to hold a license to create

money as debt, there will be no solution to this or any of the other corrupt

activities of banks. Take away their power to do something and they will buy it

back with the stroke of a pen. Banks are masters of our universe - but ONLY

because we allow them to create 97% of our money supply when they extend loans.

Until we restore the utility of money to a public accountable body in the

national interest the bankers (in collusion with the political power they can

buy so easily) will do as they please.

Bank secrecy masks a world of

crime and destructionBanks seem willing to exploit the loopholes found in tax

havens and it's costing the British taxpayer dear" (source: the guardian)…If

anybody has actually read any of my postings and comments, which is not at all

certain since I do not read other blogs, posts and comments, they will have

seen how I have been advocating the end of Tax Havens and fancy avoidance

schemes for years. I have been saying we are in a world war: the 1% against the

99%. It was in my report sent to Governments in 2009: A MORAL PATH TO RECOVERY,

which can still be read on my blog's archived posts, I maintain that Wealth Management, offered by

the big banks, is code word for tax evasion on a massive scale. It has grown

into a major industry of the rich for the rich, by the rich actually sponsored

by Governments which have allowed the privileged elite to avoid paying taxes.

And we wonder why our countries are in debt and the economies stagnating. The

banks have been exposed as virtually corrupt, fraudulent, criminal

organizations and yet not one single banker has been brought to justice. The 13

trillion dollars hidden away as calculated by the Tax Justice Network simply

must be recovered if Europe and America are to survive as democracies. The 99%

just cannot support any more austerity measures, cut backs and increased taxes.

That is the simple choice we face. The 1% know they cannot hold out for ever

but they seem too shortsighted to understand that if the majority sinks they

will go down too....Well, as long as we allow banks to hold a license to create

money as debt, there will be no solution to this or any of the other corrupt

activities of banks. Take away their power to do something and they will buy it

back with the stroke of a pen. Banks are masters of our universe - but ONLY

because we allow them to create 97% of our money supply when they extend loans.

Until we restore the utility of money to a public accountable body in the

national interest the bankers (in collusion with the political power they can

buy so easily) will do as they please.Saturday, July 21, 2012

The East provides a mirror

Since Brussels is quite happy to ignore referendum results it doesn't like,

it's hardly n a good position to lecture others about democracy.

Since Brussels is quite happy to ignore referendum results it doesn't like,

it's hardly n a good position to lecture others about democracy.

People in Eastern Europe have a healthy attachement to actual results. That's

why they get impatient with the endless process-driven talk and de facto status

quo and paralysis in most of the West (perfectly represented by EU institutions

themselves). So it is more likely to get radical ideas and non-standard

politicians in the East than in the West. East embraced nationalism,

clericalism, fascism, socialism, communism, capitalism, whatever came along as

long as the perception by people was that things might get better.

People in the east go for the jugular, game the systems, and in general act

in self-serving ways. This can be annoying, but is is also more honest and

authentic. Capitalism in the east very quickly disintagrated into plutocracy,

abuse of labor rights, tunneling of companies, and a general kleptocracy -

things that took a lot longer in the West, although it is clearly happening in

the West right now.

People in the West need to understand that abstract "systems" that don't

deliver results are just that: empty verbiage surrounding well-hidden and

self-serving power. The East provides a mirror: there can be no truly free media

that is owned by private interests, there can be no general prosperity in

dog-eats-dog capitalism, there is no such thing as "meritocracy" any more in the

West than there is one in the East, and maybe there is no such thing as "liberal

democracy", only better and worse ways to run a society.

The ugly truth is that without self-restraint by the powerful, without

growing wealth, and without external unifying threats, all these pathologies

from th East are appearing the West. The political threat of communism made the

prosperity and balanced societies the West possible (maybe inevitable). That's

gone, how are we going to do the right thing without this external

threat?

Saturday, July 14, 2012

Germany gets to show its eurosceptic side

The preamble of the constitution makes Europe into a major premise of our

constitution," says Alexander Graf Lambsdorff, the head of the pro-business Free

Democratic Party (FDP) group in the European Parliament. "Today's judges treat

it like an annoying postscript. That's alarming."

The preamble of the constitution makes Europe into a major premise of our

constitution," says Alexander Graf Lambsdorff, the head of the pro-business Free

Democratic Party (FDP) group in the European Parliament. "Today's judges treat

it like an annoying postscript. That's alarming."

Yes, and the actual central clauses of the constitution state that that all

power derives from the people.

The european parliamentarians are particularly noisy about the court daring

to interfere, at this time. They're probably still sore about the fact that the

Court ruled that the European Parliament didn't meet "international democratic

standards", and so wasn't a suitable receptacle for future transfer of

sovereignty.

From memory, the international democratic standard they saw the european

parliament failing had to do with one MEP representing 300,000 germans, and

50,000 maltese....Ah well. Germany gets to show its eurosceptic side, for a change.

Tuesday, July 10, 2012

On the question of the single currency and its survival, the majority -- 54 percent -- believes that Germany should not continue to fight to save the euro if it has to provide additional billions in aid. A sizeable minority (41 percent) disagrees, however, while 5 percent are undecided.

On the question of the single currency and its survival, the majority -- 54 percent -- believes that Germany should not continue to fight to save the euro if it has to provide additional billions in aid. A sizeable minority (41 percent) disagrees, however, while 5 percent are undecided.

The survey revealed that this skepticism is shared by Germans of almost all political affiliations. Among respondents who support Angela Merkel's conservative Christian Democratic Union (CDU) and its Bavarian sister party, the Christian Social Union (CSU), 52 percent said it was almost pointless for Germany to continue fighting for the single currency, while 45 percent disagreed. The figures are similar among supporters of the opposition center-left Social Democratic party (54 percent versus 43 percent), which has generally supported Merkel in her efforts to fight the crisis.

The greatest skepticism was found among supporters of the far-left Left Party, 68 percent of whom felt it was pointless to keep fighting to save the euro. The most pro-European tendencies were found in the camp of the environmentalist Green Party. There, 64 percent thought Germany should keep trying to rescue the monetary union.

The divide in the responses mirrors a current debate among top economists in Germany. This week, influential German economist Hans-Werner Sinn published an open letter, signed by around 170 economists, criticizing the resolutions agreed upon at the most recent European Union summit and claiming that Merkel was "forced into" agreement at the meeting. Other leading economists, including Peter Bofinger, a member of the German Council of Economic Experts that advises the German government, have reacted by attacking the letter and defending Merkel's policies.

The survey was conducted by the pollster TNS on July 3-4. Around 1,000 Germans aged 18 and over took part.

Thursday, July 5, 2012

Matters are worse in the banking sector. Each country's banking system is backed by its own government; if the government's ability to support the banks erodes, so will confidence in the banks. Even well-managed banking systems would face problems in an economic downturn of Greek and Spanish magnitude; with the collapse of Spain's real-estate bubble, its banks are even more at risk. In their enthusiasm for creating a "single market", European leaders did not recognise that governments provide an implicit subsidy to their banking systems. It is confidence that if trouble arises the government will support the banks that gives confidence in the banks; and, when some governments are in a much stronger position than others, the implicit subsidy is larger for those countries.

Matters are worse in the banking sector. Each country's banking system is backed by its own government; if the government's ability to support the banks erodes, so will confidence in the banks. Even well-managed banking systems would face problems in an economic downturn of Greek and Spanish magnitude; with the collapse of Spain's real-estate bubble, its banks are even more at risk. In their enthusiasm for creating a "single market", European leaders did not recognise that governments provide an implicit subsidy to their banking systems. It is confidence that if trouble arises the government will support the banks that gives confidence in the banks; and, when some governments are in a much stronger position than others, the implicit subsidy is larger for those countries.

In the absence of a level playing field, why shouldn't money flee the weaker countries, going to the financial institutions in the stronger? Indeed, it is remarkable that there has not been more capital flight. Europe's leaders did not recognise this rising danger, which could easily be averted by a common guarantee, which would simultaneously correct the market distortion arising from the differential implicit subsidy. The euro was flawed from the outset, but it was clear that the consequences would become apparent only in a crisis. Politically and economically, it came with the best intentions. The single-market principle was supposed to promote the efficient allocation of capital and labor. But details matter. Tax competition means that capital may go not to where its social return is highest, but to where it can find the best deal. The implicit subsidy to banks means that German banks have an advantage over those of other countries. Workers may leave Ireland or Greece not because their productivity there is lower, but because, by leaving, they can escape the debt burden incurred by their parents. The European Central Bank's mandate is to ensure price stability, but inflation is far from Europe's most important macroeconomic problem today.

AP - The European Parliament has overwhelmingly defeated the international ACTA anti-piracy agreement, after fears that it would limit Internet freedom mobilized broad opposition across Europe.

The vote Wednesday was 39 in favor, 478 against, with 165 abstentions.

The defeat means that, as far as the EU is concerned, the treaty is dead - at least for the moment - though other countries may participate.

A spokesman for the European Commission, the EU’s executive arm, said it may try again after it obtains a court ruling on whether the agreement violates fundamental EU rights.

Supporters said ACTA - the Anti-Counterfeiting Trade Agreement - was needed to standardize international laws that protect the intellectual property rights.

Opponents feared it would lead to censorship and a loss of privacy on the Internet

AP - The European Parliament has overwhelmingly defeated the international ACTA anti-piracy agreement, after fears that it would limit Internet freedom mobilized broad opposition across Europe.

The vote Wednesday was 39 in favor, 478 against, with 165 abstentions.

The defeat means that, as far as the EU is concerned, the treaty is dead - at least for the moment - though other countries may participate.

A spokesman for the European Commission, the EU’s executive arm, said it may try again after it obtains a court ruling on whether the agreement violates fundamental EU rights.

Supporters said ACTA - the Anti-Counterfeiting Trade Agreement - was needed to standardize international laws that protect the intellectual property rights.

Opponents feared it would lead to censorship and a loss of privacy on the Internet

Subscribe to:

Comments (Atom)